Gap (NYSE:GPS) stock surged 8.6% on Thursday as the apparel retailer partnered with Amazon (NASDAQ:AMZN) to sell some of its products on the e-commerce giant’s platform in the U.S. and Canada. The move seems to be a part of Gap’s efforts to revive its sales.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Gap will be selling a selection of its merchandise, including hoodies, t-shirts, denim, socks, intimate clothing, and sleepwear on Amazon Fashion. The company will also offer babyGap-branded nursery furniture and baby gear like strollers, bassinets, and cribs on Amazon.

In July 2022, Gap announced the abrupt departure of CEO Sonia Syngal. Notably, Syngal, who took charge in early 2020, tried to turnaround the company through the Power Plan 2023 strategy. However, the company continued to post disappointing sales and profitability. Since the departure of Syngal, Bob L. Martin is serving as the Interim CEO and executive chairman of the board.

As part of its streamlining efforts, Gap recently announced the sale of its Greater China business to Baozun Inc. for $40 million. The transaction is expected to be completed in the first half of 2023.

Is Gap a Buy or Sell?

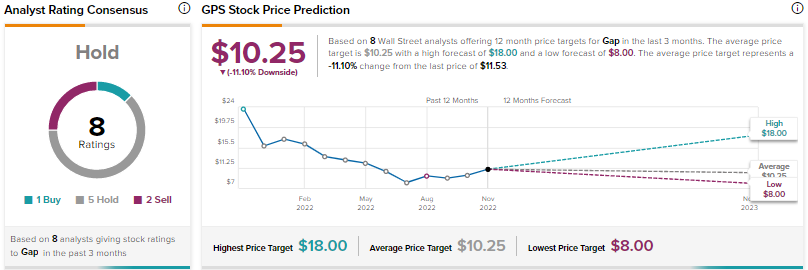

Wall Street is sidelined on Gap stock, with a Hold consensus rating based on one Buy, five Holds, and two Sells. The average GPS stock price target of $10.25 implies downside potential of 11.1%. Shares have already plummeted 34.7% year-to-date.