Shares of GameStop Corp. plunged 17.4% in Tuesday’s extended trading after the video game retailer reported lower-than-expected 3Q sales and announced a stock sale plan.

GameStop’s (GME) 3Q revenues declined 30.2% to $1 billion year-on-year and lagged analysts’ expectations of $1.09 billion. The company’s adjusted loss per share widened to $0.53 from $0.49 in the year-ago period but came ahead of the Street’s estimates of a loss per share of $0.85.

GameStop’s CEO George Sherman said, “Our third quarter results were in-line with our muted expectations and reflected operating during the last few months of a seven-year console cycle and a global pandemic, which pressured sales and earnings. (See GME stock analysis on TipRanks)

Additionally, GameStop announced that it has entered into an open market sale agreement with Jefferies LLC to sell up to $100 million of its Class A common stock.

GameStop did not provide any forward-looking guidance citing the pandemic-related uncertainties. However, the company said that “it expects to realize positive comparable store sales results and profitability in the fiscal fourth quarter.”

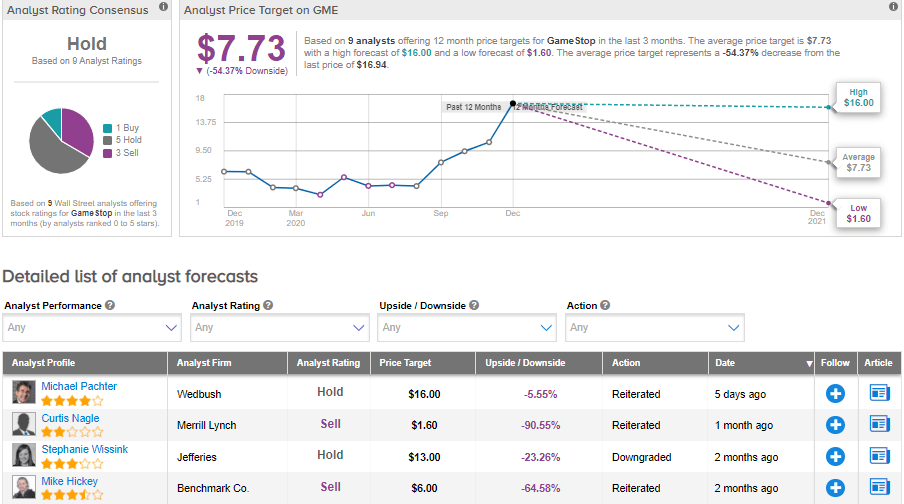

Ahead of its earnings, on Dec. 4, Wedbush analyst Michael Pachter doubled the stock’s price target to $16 (5.6% downside potential) from $8 and reiterated a Hold rating. In a note to investors, Pachter wrote, “GameStop is well-positioned to be a primary beneficiary of the new console launches, and we remain optimistic that it will return to profitability relatively soon.”

Overall, the Street is sidelined on the stock. The Hold analyst consensus is based on 5 Holds, 1 Buy and 3 Sells. Following this year’s 178.6% share rally, the average price target now stands at $7.73 and implies downside potential of about 54.4% to current levels.

Related News:

Stitch Fix Surprises With 1Q Profit; Shares Spike 34%

Smartsheet Soars 17% On 4Q Guidance Beat After 3Q Win; Needham Raises PT

Casey’s Falls Despite 2Q Earnings Beat And Dividend Hike