A few years ago, GameStop (NYSE:GME) investors were watching shares soar into the stratosphere, fueled by stimulus money and “diamond handed” investors out to beat the shorts. Now, GameStop has come back down to Earth, as the game retailer lost over 4.5% in Monday afternoon’s trading following a deeply unpleasant earnings report.

The numbers were a bloodbath. Gross profit was down 16%, and revenue was down 20%. These aren’t down from record highs, either; these are down from a continuing string of declines that’s been going on for some time now. In fact, reports suggest that investors are already bracing for impact as more bad news is likely to hit.

Yet the problem may not be as bad as first envisioned. Legendary analyst Michael Pachter, who’s been covering the game beat for a long time now, noted that GameStop’s current cash balance is sufficient to weather annual losses of $100 million for “…a decade or more.” However, if losses proceed at a higher rate, that will cut the runway accordingly. Pachter projects it’s about five years until GameStop has serious trouble on its hands.

The New International Buggy Whip?

While GameStop is actively working to protect itself—it’s already announced plans to stage some hefty job cuts coming up—it may not be able to protect itself from the biggest trouble of all: a rising tide of digital sales. GameStop’s primary stock in trade for decades has been used games. With used games in a state of rapid decline as customers are buying games directly from publishers or certain exchanges like Steam, GameStop is losing a lot of ground. Many of the latest games can’t even be purchased physically, and that’s bad news for a company that made its name on trading just that.

Is GameStop a Buy, Sell or Hold?

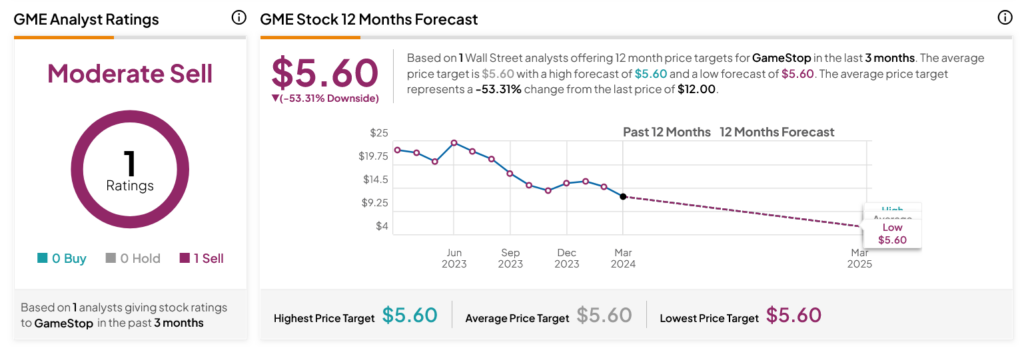

Turning to Wall Street, analysts have a Moderate Sell consensus rating on GME stock based on one Sell rating from analyst Michael Pachter assigned in the past three months, as indicated by the graphic below. After a 48.34% loss in its share price over the past year, the average GME price target of $5.60 per share implies 53.31% downside risk.