The Super Bowl is easily one of the biggest sporting events in a year. Commanding around $7 million per ad, it’s easy to see why it’s a draw for marketers. But for casino stocks and sportsbook operations, it’s a major draw for a completely different reason. Reports suggest that, despite everything bad about the economy you’ve heard in the last few weeks, nothing stopped bettors from plunking down a few bucks on the game’s outcome. The average betting handle was up 27% against 2023’s Super Bowl in New Jersey, New York, and Nevada.

Not everyone got an equal boost, though, as FanDuel from Flutter Entertainment (NYSE:FLUT) saw a 43% jump, and BetMGM (NYSE:MGM) saw performance up over 30%. However, gross gaming revenue (GGR) proved down for many overall thanks to exposure to the Kansas City Chiefs winning in a game that saw over 46 points scored.

Even the NFL Got Involved

The NFL, for its part, wasn’t always interested in gambling. While it knew it happened—Super Bowl pools have been going back decades at offices and even some schools—it wasn’t interested in being directly connected. However, with the growing exposure the NFL is enjoying as a result, it’s likely changing its mind. Some even interpret the NFL’s decision to have the Super Bowl in Las Vegas as a sign of that sea change. This all traces back to a Supreme Court decision in 2018 that opened up the potential for legalized sports betting, which all sides—even the NFL—embraced.

Which Gambling Stocks Are a Good Buy Right Now?

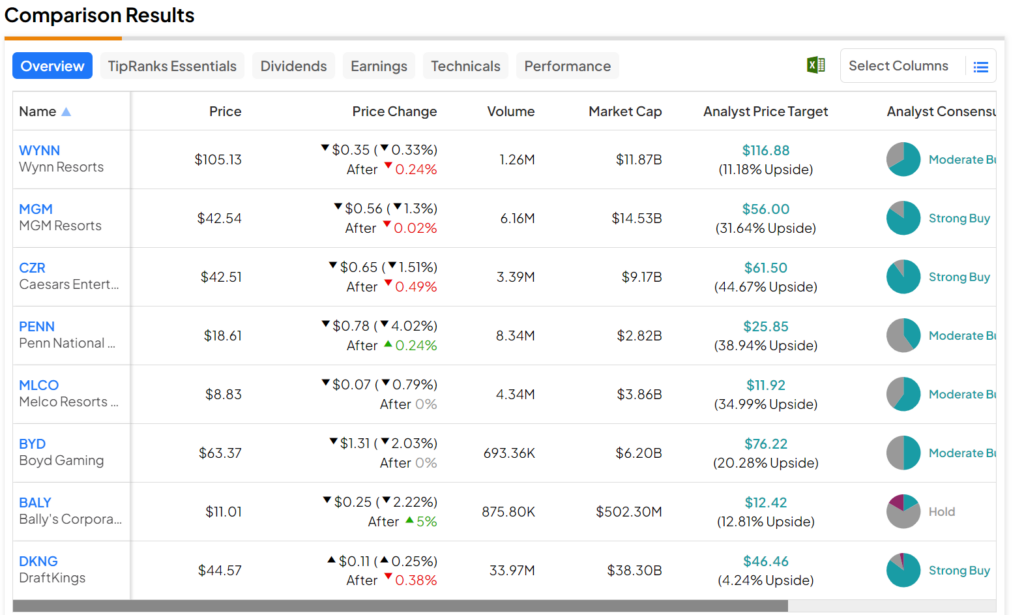

Turning to Wall Street, the leader in the sector right now is CZR stock (NASDAQ:CZR). With an average price target of $61.50, this Strong Buy-rated stock offers investors a 44.67% upside potential. Meanwhile, DKNG stock (NASDAQ:DKNG) is the laggard in the sector, as this Strong Buy can only offer a 4.24% upside potential against its average price target of $46.46.