Institutional investors are buying more stocks than ever, but they are now also showing a stronger preference for gold (GLD) over tech stocks, according to Bank of America’s (BAC) October fund manager survey. In fact, 43% of fund managers said that “long gold” is the most crowded trade this month, while 39% said the same about the “Magnificent 7” tech stocks. That’s a big shift from September, when 42% of respondents picked the Magnificent 7 as the most crowded and only 25% chose gold.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The change in attitude makes sense when considering that gold is up 14.3% over the past four weeks, while the Magnificent 7 are slightly down 0.5%. Interestingly, JPMorgan (JPM) recently described this shift as the “debasement trade,” where investors seek safer assets to protect against inflation and market volatility. At the same time, there’s been more talk about a possible bubble forming around AI-related stocks. In fact, one-third of fund managers in BofA’s survey now say that the biggest market risk is an “AI equity bubble,” which is a concern that didn’t even rank in the top three just last month.

However, despite these worries, many investors continue to invest in the market. For example, in another report released on Wednesday, BofA said that its clients bought the dip after the S&P 500 (SPY) dropped 2.4% last week. That followed four weeks of net selling. Moreover, inflows into individual stocks reached $4.1 billion, the fifth-highest level since 2008, and institutional inflows hit their highest point since November 2022. Still, hedge funds continued to sell off stocks for the fifth week in a row, which shows that not all investors are feeling optimistic.

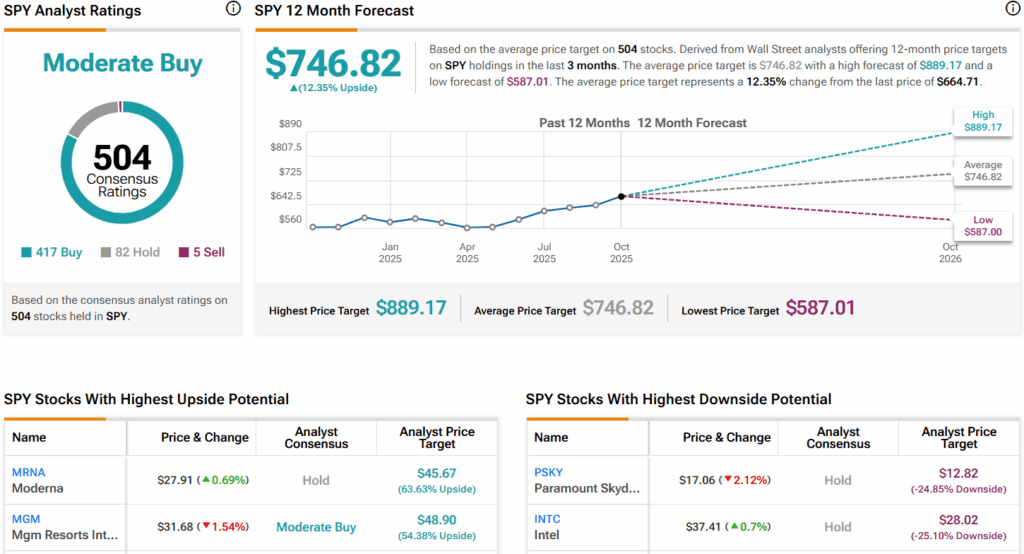

Is SPY Stock a Good Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SPY stock based on 417 Buys, 82 Holds, and five Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPY price target of $746.82 per share implies 12.4% upside potential.