Online entertainment platform Roblox (RBLX) has been one of the standout performers in the gaming and metaverse space, with shares up 127% year-to-date. While some investors question the stock’s valuation after such a strong rally, I believe there’s still more upside as user growth, engagement, and monetization all point to another potential beat in Q3.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

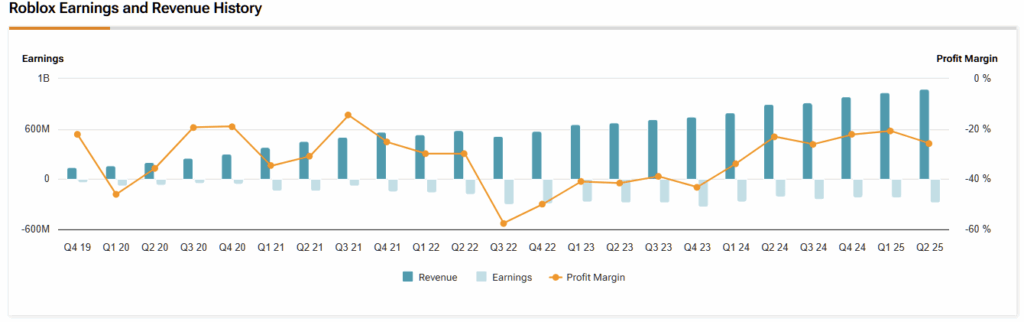

Over the past 10 quarters, Roblox has missed EPS estimates only three times and revenue estimates just twice, consistently outperforming Wall Street expectations. As the company prepares to report its Q3 2025 earnings on Thursday, investors may be left wondering whether Roblox can sustain its explosive growth momentum — and whether its fundamentals can finally catch up to its lofty valuation.

According to TipRanks data, consensus forecasts currently call for EPS of -$0.49 and revenue of $1.70 billion. While analysts have reduced EPS expectations by 37% over the last year, they’ve also raised revenue forecasts by more than 40%, reflecting strong underlying business trends.

Even with consensus already pricing in an earnings beat versus earlier guidance, I see further upside supported by strong intra-quarter metrics. In Q2 2025, Roblox reported revenue of $1.1 billion, up 21% year over year, and bookings of $1.4 billion, a 51% increase, driven by broad-based growth across all regions — including an impressive 75% surge in APAC. The platform also achieved record engagement, with hours spent climbing 41% to 27 billion, underscoring sustained user enthusiasm and platform stickiness.

User Data Suggests Another Record Quarter

Third-party data paints a picture of accelerating momentum. According to Romonitor, average concurrent users (CCUs) during Q3 rose roughly 70% sequentially and an impressive 128% year-over-year. Meanwhile, Similarweb data shows app daily active users (DAUs) up 81% year-over-year, a stronger growth rate than Q2.

Breaking this down further, growth trends remained remarkably strong across the quarter — with CCUs up 104% in July, 145% in August, and 137% in September — boosted by viral in-game events like Grow a Garden, Steal a Brainrot, and the platform-wide event The Takeover in mid-September.

If this DAU momentum continues, I estimate Roblox could report around 140 million daily active users, well above the current Street estimate of 128 million. That level of engagement would likely translate into bookings of about $1.9 billion, compared to the $1.69 billion analysts expect.

For Q4, I don’t expect management to fully extrapolate this upside into guidance, as Roblox typically remains conservative. However, I anticipate bookings guidance around $1.9 billion, comfortably ahead of consensus at $1.82 billion.

Long-Term Growth Story Still Intact

Beyond short-term catalysts, I remain bullish on Roblox’s long-term monetization potential. The company is in the early stages of unlocking value from its massive non-paying user base, with roughly 80% of engagement hours still unmonetized. Its growing push into advertising — including immersive branded experiences — is opening new revenue channels that complement its core virtual currency model.

Additionally, Roblox continues to strengthen its appeal to developers and content creators by offering a higher revenue share on in-app purchases. This move, closer to the revenue split offered on consoles and app stores, is expected to attract more premium content and well-known gaming franchises to the platform.

Over time, I believe these efforts will cement Roblox as a leading next-generation gaming platform, enabling it to capture an expanding share of global engagement and digital spend. The company’s ongoing investment in AI tools for creators, combined with its massive scale and social stickiness, gives it a competitive edge that’s difficult to replicate.

Premium Valuation Without Becoming a Dealbreaker

Yes, Roblox looks expensive by traditional valuation metrics. The company trades at a forward EV/EBITDA of 61x, versus the sector median of just 8.4x, and a forward Price/Cash Flow multiple of 57x, compared to 8.2x for its peers.

However, these ratios don’t fully capture Roblox’s unique growth profile. As a company still in its hypergrowth stage, with substantial reinvestment needs, conventional valuation frameworks can be misleading. Roblox has achieved a five-year average revenue growth rate of nearly 50% and a five-year average operating cash flow growth rate above 70%, which are exceptional in the sector.

Given Roblox’s structural growth drivers and platform network effects, I believe the market may continue to assign a valuation premium as long as the company sustains double-digit growth and margin expansion.

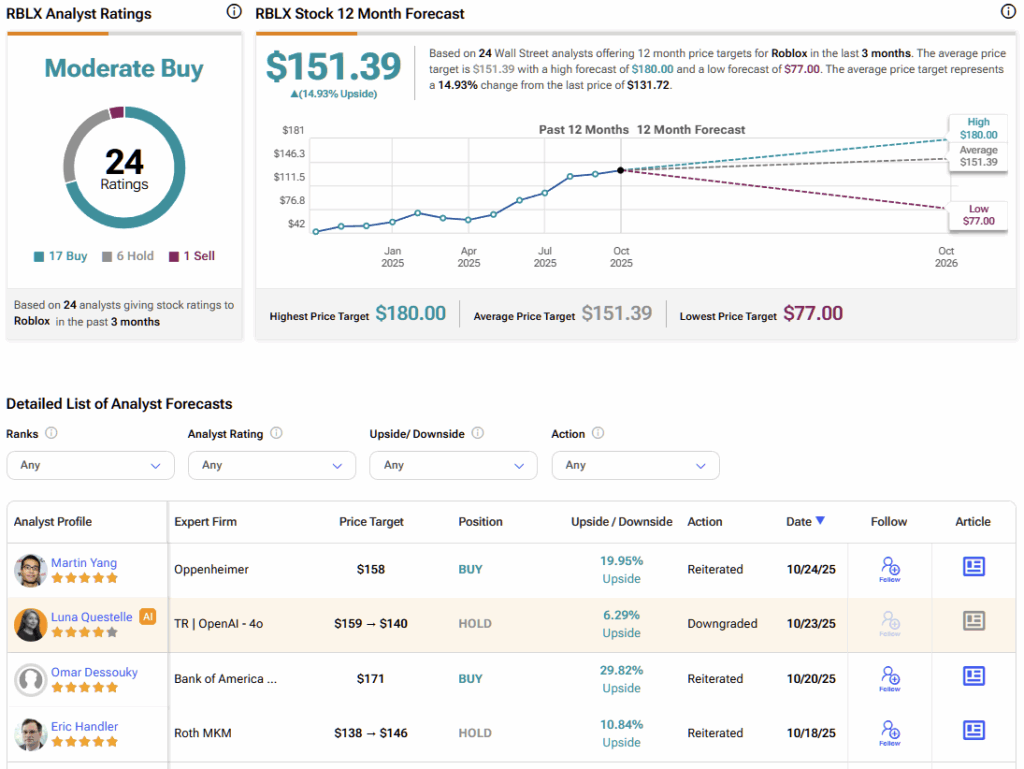

Is RBLX a Good Stock to Buy?

According to TipRanks, Roblox carries a Moderate Buy consensus rating based on 24 analyst reviews, including 17 Buys, 6 Holds, and 1 Sell. The average stock price target stands at $151.39, implying nearly 15% upside over the coming year.

Roblox’s Momentum Builds Ahead of Earnings

Roblox continues to outperform expectations, driven by accelerating user growth, deeper engagement, and an expanding monetization toolkit. Current data points to another standout Q3, with potential upside in both bookings and daily active users.

While the stock’s valuation remains elevated, that premium appears justified given Roblox’s category leadership, scalable platform economics, and powerful network effects. As long as the company continues translating engagement into revenue, its long-term growth trajectory remains firmly intact. With these dynamics in play, I remain bullish on Roblox heading into earnings.