Tech giant Microsoft (NASDAQ:MSFT) has agreed to pay $20 million in charges to the U.S. Federal Trade Commission (FTC) for violating the Children’s Online Privacy Protection Act (COPPA) by collecting personal data from children who signed for its Xbox gaming system, without notifying or obtaining their parents’ consent and by illegally retaining the information.

“Our proposed order makes it easier for parents to protect their children’s privacy on Xbox, and limits what information Microsoft can collect and retain about kids,” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection.

Under the proposed order filed by the Department of Justice (DOJ) on behalf of the FTC, Microsoft will have to implement several measures to bolster privacy protections for child users of its Xbox console. A federal court must approve the order before it becomes effective. Further, the order extends COPPA rules to third-party gaming publishers with whom the company shares the information collected from children.

Microsoft blamed a “technical glitch” and assured that it will address the matter to comply with the order. The company intends to update its account creation process and plans to develop next-generation identity and age validation processes. It has agreed to erase within two weeks any information collected about kids without parental consent.

Last week, e-commerce giant Amazon (NASDAQ:AMZN) agreed to pay $25 million to settle charges related to violation of children’s privacy rights by failing to delete Alexa recordings at parents’ request and keeping them longer than needed. Previously, Alphabet’s Google (NASDAQ:GOOGL) (GOOG) and ByteDance’s TikTok were fined by the FTC for COPPA violations.

Is Microsoft a Good Stock to Buy?

On Monday, Bernstein analyst Mark Moerdler boosted the price target for Microsoft stock to $380 from $342 and maintained a Buy rating. The analyst noted that while the company’s Azure business decelerated in the past quarter, management commentary was optimistic. In particular, management expects artificial intelligence (AI) services to contribute about 1% to Azure’s incremental growth next quarter.

Based on Microsoft’s AI initiatives, Moerdler believes that the company has taken the AI mantel from Google and Azure could emerge as a bigger and more important hyperscale provider than Amazon Web Services (AWS).

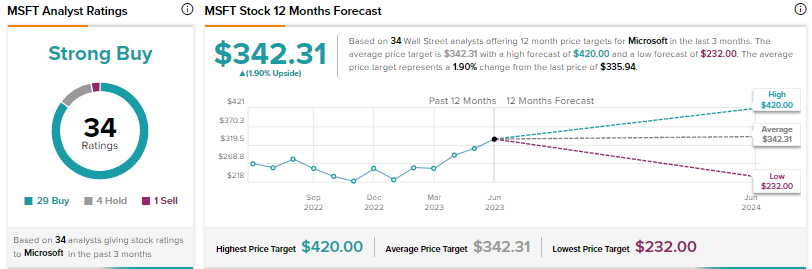

Wall Street’s Strong Buy consensus rating on MSFT is based on 29 Buys, four Holds, and one Sell. The average price target of $342.31 implies 1.9% upside.