Chips stocks have been an investor favorite over the past year, but not all names have enjoyed the market’s spoils. While many in the sector have been piling on the gains, shares of Navitas Semiconductor (NASDAQ:NVTS) have been heading in the opposite direction, showing year-to-date losses of 46%.

The small cap is a designer of power chips utilizing Gallium Nitride (GaN) and Silicon Carbide (SiC). These materials, classified as wide band-gap (WBG) semiconductors, offer advantages over traditional silicon substrates in specific applications. Essentially, WBG semiconductors can deal with higher voltages and perform in a more efficient manner. Consequently, GaN and SiC are increasingly employed in fast-charging systems, EVs, and premium mobile devices.

The company’s success can be seen in some very robust growth. In its latest quarterly readout, for 4Q23, revenue climbed by 111% year-over-year to $26.06 million, just edging ahead of consensus by $0.67 million. Navitas also beat expectations on the bottom-line, as adj. EPS of -$0.04 outpaced the forecast by $0.01.

But part of the downbeat sentiment can be attributed to a disappointing outlook. Due the effects of seasonality and various macro headwinds (interest rates, softer end market demand) impacting the entirety of its end markets, the company guided for Q1 revenues of $23 million at the midpoint, below the Street at $24.4 million. Moreover, having previously projected strength through the first half of 2024, through much of the period the company now expects weakness to persist, with the prospect of a significant recovery being postponed until the second half of 2024.

That said, it is the prospect of long-term growth which fuels Deutsche Bank analyst Ross Seymore’s bullish stance.

“As NVTS continues to make progress towards its long-term goals, further accelerates on its new end-market expansion targets now with the inclusion of GeneSiC (which the company acquired in 2022) and starts to deliver attractive revenue growth, investors’ confidence should continue to rise, benefiting NVTS’s share price substantially,” said the 5-star analyst.

While Seymore, who ranks in the top 1% of Street stock pros for the accuracy of his recommendations, is among the few analysts to not take a bullish stance on Nvidia, his outlook for Navitas Semiconductor is quite different. He rates Navitas shares as a Buy, with a $9 price target reflecting potential one-year growth of ~107% from current levels. (To watch Seymore’s track record, click here)

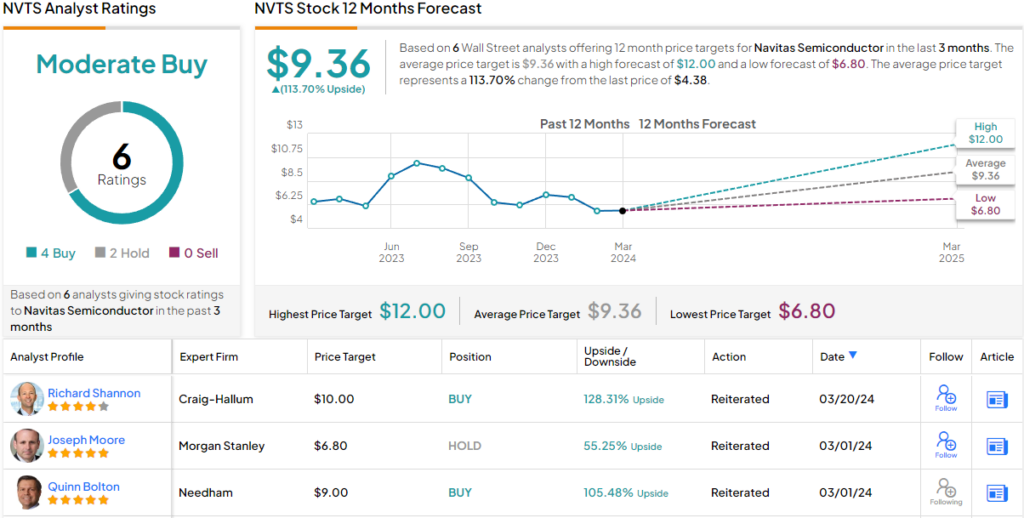

Overall, Seymore sees eye to eye with 3 other analysts who rate NVTS a Buy, and with the addition of 2 Holds, the stock receives a Moderate Buy consensus rating. The average target is even more bullish than Seymore’s objective; at $9.36, the figure implies shares will post growth of ~114% in the year ahead. (See Navitas stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.