One of the biggest unanswered questions in the entire auto industry was the matter of tariffs. Though they are still going on to a certain extent, trade deals are being established and tariff figures are stabilizing. Reports note that the automobile industry, including legacy automaker Ford (F), now has a little dose of that stability itself as tariff rates are now set thanks to a European Union trade deal. The news hit investors oddly flat, though, and shares slipped fractionally in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The tentative agreement between the United States and the European Union appears to be finalized, reports noted, and now, imported European automobiles and auto parts will now have a 15% tariff instead of the 25% tariff we had previously. There are even some carved-out exemption points, particularly for aircraft, aircraft parts, and generic pharmaceuticals.

Some raw materials even got exemptions, like nickel, magnesium, graphite, certain rare earth elements, and more. Though there are some sticking points yet to consider. First, there are possible further tariffs coming on some auto parts to reflect concerns about national security. Second, there is the matter of the United States Court of Appeals, which ruled that President Trump does not have the legal authority to set these tariffs to begin with.

Ramping Up

Ford will be needing those parts and materials, because further reports noted it plans to ramp up production on its Mustang GTD lineup. This car’s production levels started out a bit light, reports noted, but started to pick up as time went on. And one of the biggest jumps of all is set to come.

Interestingly, so far for 2025, the GTD line has produced a grand total of 118 units, though the numbers so far end in August as September’s numbers have yet to conclude. And production is currently capped at 1,700 total units. While the exact numbers on future production are not yet clear, the current word says that the production for the rest of the year is set to make a serious push for the 1,700 cap. With these cars valued at over $300,000 each, this could be a nice win for Ford, if it can produce.

Is Ford Stock a Good Buy Right Now?

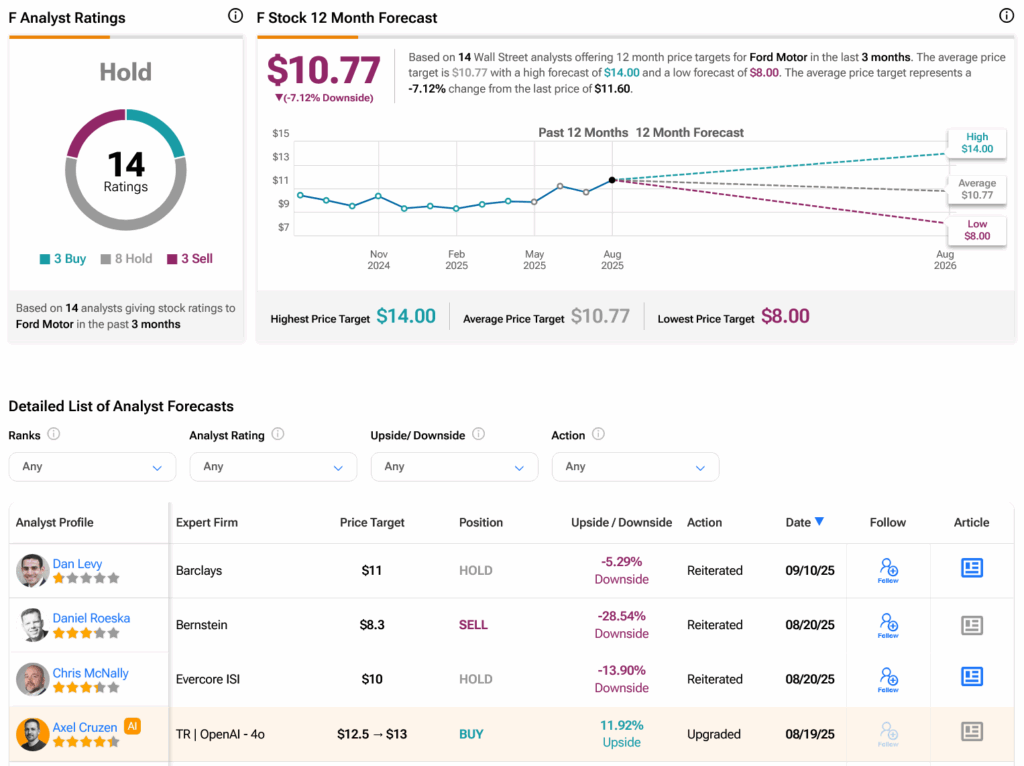

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on three Buys, eight Holds and three Sells assigned in the past three months, as indicated by the graphic below. After an 8.9% rally in its share price over the past year, the average F price target of $10.77 per share implies 7.12% downside risk.