Legacy automaker Ford (F) has got a show for you, especially if you are looking for reasons to continue investing in Ford. September 30, Ford will bring out its CEO, Jim Farley, to talk about the “Essential Economy,” and also talk about how Ford Pro helps keep those three million businesses and industries running. This was good enough news for investors. Ford shares gained fractionally in Monday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s called the Ford Pro Accelerate Livestream, and it will not only feature Farley but also “fellow business leaders” who will be talking about the Essential Economy. Farley has talked about the Essential Economy before, mostly in terms of how knowledge and “white-collar” workers have seen substantial productivity gains, but the Essential Economy is actually down in productivity.

Farley, for his part, believes that there could be a massive growth spurt in the Essential Economy; an Aspen Institute report rang assent, saying “If productivity in the Essential Economy had kept pace with its growth over 20 years prior, US GDP would be 10 percent higher today.” And Ford has anecdotes ready to go about its own support via Ford Pro, including how its vehicles back up a mobile equine veterinarian.

Brickyard Win

Ford’s racing ambitions, meanwhile, seem to be holding up. Ford Multimatic Motorsports recently took its show on the road to Indianapolis, where the Brickyard—Indianapolis Motor Speedway—played host to yet another win for Ford.

Ford’s car, a Mustang GT3, only managed to qualify for the race by the skin of its teeth, reports noted. It ended up taking the seventh position in an 11-car field, and seemed almost an afterthought. But after a clever move in which it skipped out on a pit stop, it managed to shoot itself all the way up to a second-place slot. From there, Ford managed to make a comeback win and secure yet another victory.

Is Ford Stock a Good Buy Right Now?

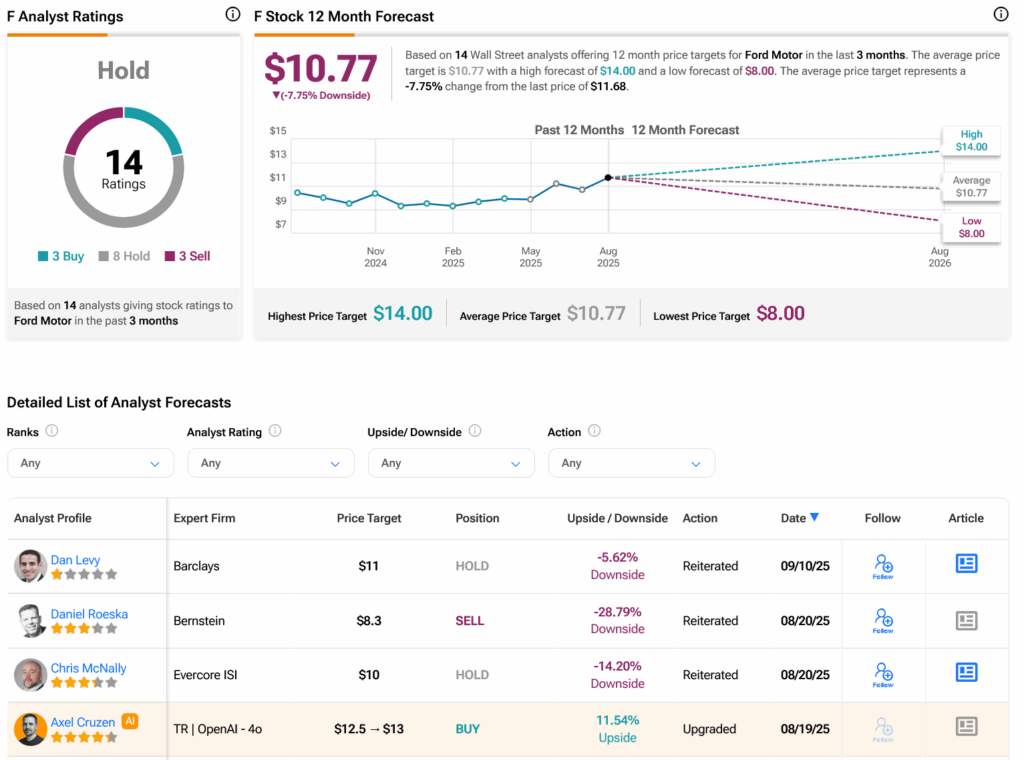

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on three Buys, eight Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 6.51% rally in its share price over the past year, the average F price target of $10.77 per share implies 7.75% downside risk.