There are times when I think that legacy automaker Ford (F) simply cannot win. Even when things go right for Ford, they still do not go well. Ford recently released information about its October sales figures, and the news was fairly decent, if not overwhelming. Investors must have expected overwhelming, because they sent shares down fractionally in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ford sales showed a gain of 1.6% for October 2025, when compared to October 2024’s figures. Gasoline vehicles led the way in October, as electric vehicle sales plunged thanks to the loss of the $7,500 federal tax incentive for EV purchases.

Ford reported it sold 175,584 vehicles in October, and so far this year has sold a combined total of 1,834,492. That in turn is up 6.6% against the same 10-month period in 2024. However, its electric vehicle sales dropped about 25%, selling only 4,709 vehicles that month. The figure for the last 10 months, meanwhile, is a little better; it sold 74,309 electric vehicles in that period, which is 0.5% higher than it was in the same period in 2024. And with leases accounting for about 71% of all financed EV purchases according to Edmunds, the loss of the government credit was a serious problem for Ford.

A Strange Marketing Question

Ford’s advertising has long focused on how Ford connects with America. These days, though, that is a difficult statement to make. One great, and oddly terrifying, question emerged when considering Ford’s advertising of late: “How do you sell America when no one agrees on what America is?”

With Ford already part of trade war operations and diplomatic relations—reports suggest Japan’s new Prime Minister Sanae Takaichi drove an F-150 to a meeting with President Trump—Ford’s recent efforts to revive old advertising, particularly the “Opening the highways to all mankind” series, met with mixed results. It leaves Ford in something of an odd position; can it actively declare travel American as many Americans believe travel should be curtailed, among other things?

Is Ford Stock a Good Buy Right Now?

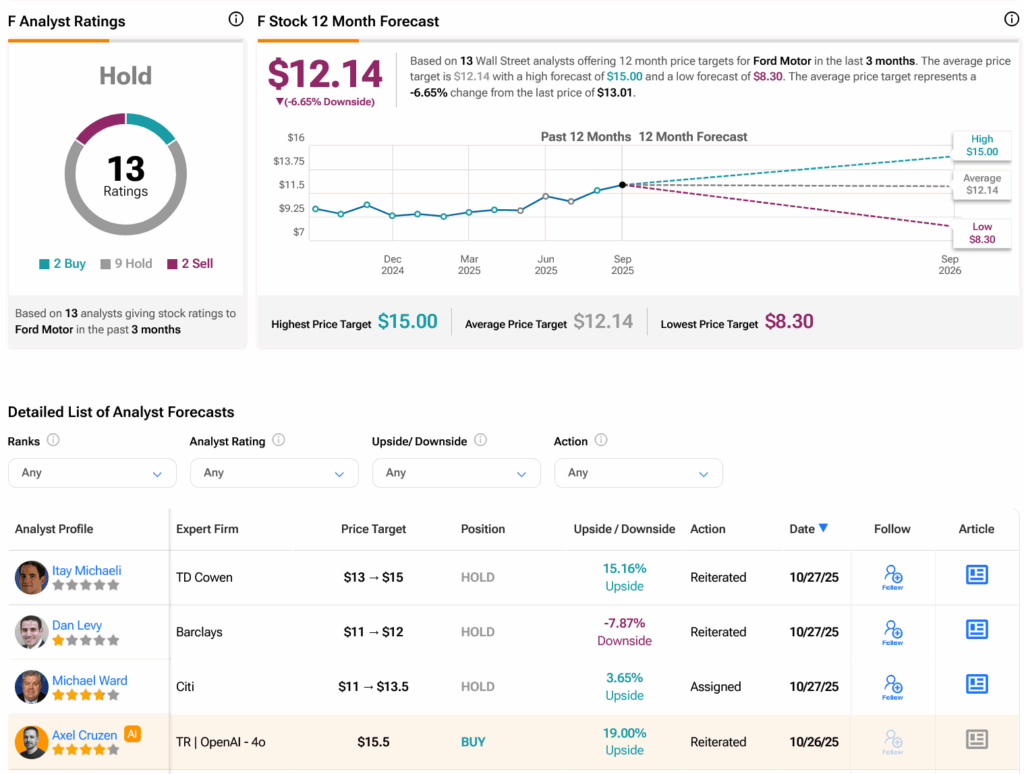

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on two Buys, nine Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 26.74% rally in its share price over the past year, the average F price target of $12.14 per share implies 6.65% downside risk.