This one might make any encounter between legacy automaker Ford (F) and the Trump administration a bit awkward for the next couple of years. Ford is planning to put a big investment into place, about $370 million, to help build engines. The problem is that the investment in question will go to India. The move proved at least somewhat welcome to investors as shares notched up slightly in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Four years ago, reports note, Ford shut down a factory in India that was making engine parts. Now, Ford is looking to get that factory back online, and will put the roughly $370 million in question to work in aid of that. Located in Tamil Nadu, the Maraimalai Nagar site is looking to put out over 200,000 engines per year. Interestingly, the engines are not meant to come back to the United States, but it is unclear just where the engines will go.

Interestingly, Ford had an opportunity to set up a different deal back in 2020, when Jim Farley first became CEO of Ford. It was set to make a deal with Mahindra & Mahindra Ltd., which in turn would have kept Ford vehicles in play in India. But since India was then considered a “marginal” market, like Brazil, Ford decided to pull back and keep its capital instead.

China Can “Put Us All Out of Business”

Meanwhile, Jim Farley is also deeply concerned about the state of the global market, believing the very real possibility that China could put every American automaker out of business. Farley noted that China currently has enough production capacity to cover the entire North American market, which would render Ford and its contemporaries largely extraneous in their own backyard.

Farley compared this development to the Japanese car market of the 1980s, which was significant, but even back then, much smaller. China’s industrial potential is staggering, and this poses what Farley called “…a completely different level of risk for our industry.” This in turn prompted several changes at Ford, though it remains to be seen if these will be sufficient.

Is Ford Stock a Good Buy Right Now?

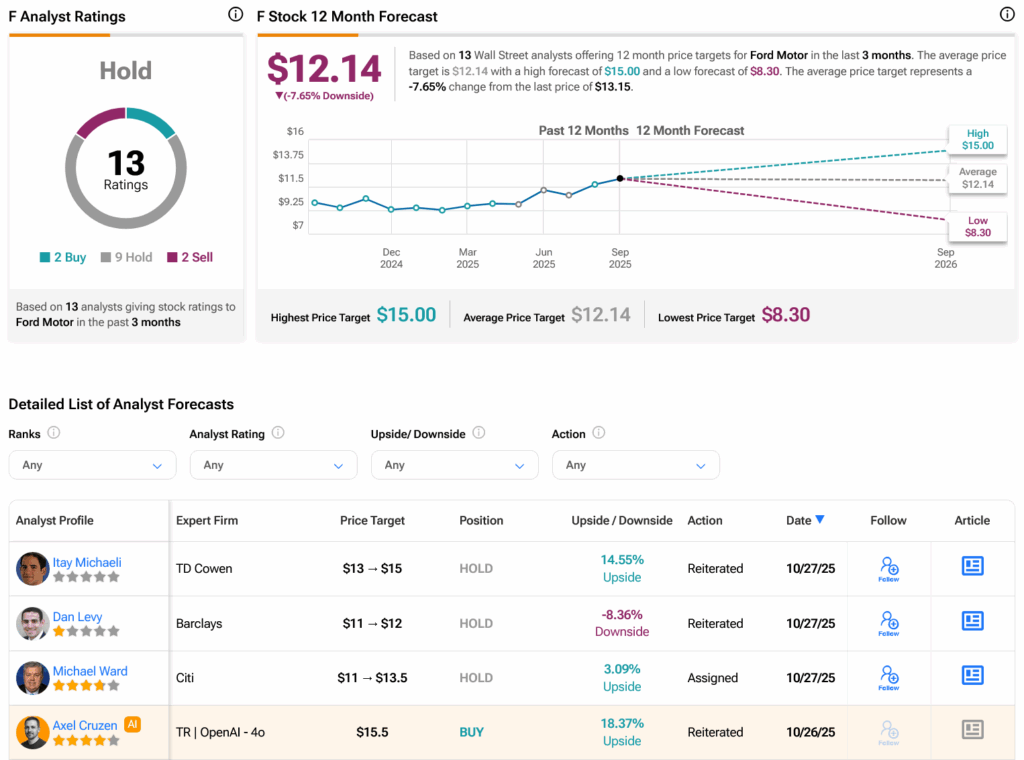

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on two Buys, nine Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 27.79% rally in its share price over the past year, the average F price target of $12.14 per share implies 7.65% downside risk.