On October 16, Bill Ford, the executive chairman of Ford Motor Co. (NYSE:F), made his first remarks about the ongoing strike by the United Auto Workers (UAW) union. Ford said the prolonged strike would hurt the U.S. auto industry and “devastate” local communities. Plus, the strike would benefit all the other players, such as Honda (NYSE:HMC), Toyota (NYSE:TM), Tesla (NASDAQ:TSLA), and all other Chinese companies that seek to enter the U.S. market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The strike between the UAW and the Big Three automakers, namely Ford, General Motors (NYSE:GM), and Stellantis (NASDAQ:STLA), has entered its second month. Ford warns that a continuation of the strike would hamper Ford’s ability to compete efficiently in the market. Moreover, it could impact Ford’s finances, resulting in plant closures and several job losses. Ultimately, these would impact the future of the American auto industry, he added.

Following Ford’s remarks, UAW President Shawn Fain threatened to walk out of the Rouge factory, where the F-150 pickup trucks are manufactured. Fain commented, “It’s not the UAW and Ford against foreign automakers… it’s autoworkers everywhere against corporate greed.”

Ford’s Ongoing Battle with the UAW

The UAW has walked out at three of Ford’s plants so far, the last one being the Kentucky truck plant, one of Ford’s largest and most profitable units. Ford’s latest proposal includes a 23% wage increase over the contract’s life, return of cost-of-living adjustments, and other benefits. The executive chair stated that this is the best that Ford can afford, and any further raise could make the company economically unviable.

At the same time, Ford has also rejected the union’s proposal to include all future battery manufacturing plants under the master agreement. Ford’s battery ventures are jointly owned by Korean manufacturer SK Innovation and, thus, cannot be included in the labor deal.

Is Ford a Buy, Sell, or Hold Stock?

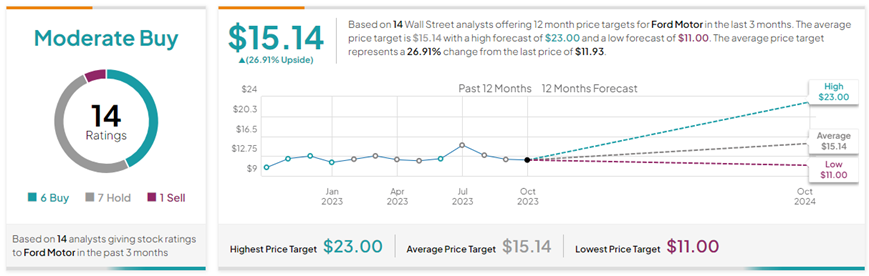

Wall Street is cautiously optimistic about Ford’s stock trajectory owing to the ongoing disturbances. Based on six Buys, seven Holds, and one Sell rating, Ford has a Moderate Buy consensus rating on TipRanks. Also, the average Ford Motor Co. price target of $15.14 implies 26.9% upside potential from current levels. Year-to-date, F stock has gained 11.2%.