While the electric vertical takeoff and landing (eVTOL) aircraft industry has been all the rage, the valuations of individual sector players have been all over the map. Joby Aviation (NYSE:JOBY) is no exception. Ahead of its fourth quarter of Fiscal 2024 earnings report, management presumably needs to deliver a compelling narrative. If successful in that directive, the eVTOL specialist could fly higher. Moreover, call options provide additional leverage for the optimist.

Therefore, I am bullish on JOBY stock and have a call options position in it as well.

Establishing a Framework for JOBY Stock Calls

For the unaccustomed, diving into the derivatives market for the first time can be daunting. With various strike prices, expiration dates, and bid-ask spreads, it’s difficult to understand where the first step should take place. Before moving any further, though, we need to recognize the basics.

First, unlike buying JOBY stock in the open market, an option contract doesn’t have value in and of itself. Instead, it derives its value from the underlying security. Two metrics you must always keep in mind are your strike price – the price at which you can exercise the contract – and the expiration date.

Second, when assessing which option represents a “good deal,” you must think in terms of worst-case scenarios; that is, you should assume that your target security – JOBY stock, in this case – must exceed the baseline intrinsic value of your option. This statement segues into another point. Options carry time value and intrinsic value.

Time value is exactly what it sounds like. The more time you have before your option expires, the more value your option has. However, if your option is on the cusp of expiration, you have zero time value and only intrinsic value. In other words, if you were to exercise the contract instead of selling it, would you be profitable?

Here, an example would be most helpful. Among near-expiry options listed in TipRanks’ unusual options screener, let’s pick the JOBY Apr 19 ’24 5.00 Call. On Friday, the price of the contract closed at $1.54, or a total cost of $154 (price multiplied by 100 shares). Assuming an exercising of this contract, the complete cost of the $5 call would be $654 (strike price multiplied by 100, and adding the aforementioned $154).

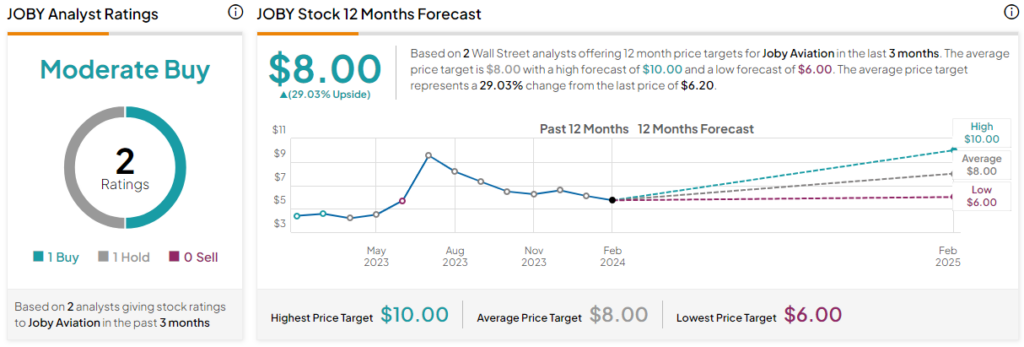

Assuming the average forward-12-month price target from analysts of $8 is broken down linearly, by April, JOBY stock should trade at $6.50 (gaining 15 cents per month on average based on the average price target, with the current stock price being $6.20). Multiply this figure by 100 shares, and you would have a loss of $4.

Broadening the Horizon for Joby Aviation Options

Of course, -$4 is not ideal. Even if the high-side target of $10 were to pan out 12 months from now (gaining 31.7 cents on average per month), by expiration in April, the stock would be trading at around $6.83, meaning your total profit would be $29. That’s not something to write home about. So, you would need to consider other ideas.

A better one that materialized was the JOBY Oct 18 ’24 5.00 Call. Here, the contract closed at $2.30 on Friday, or a total price of $230. Combined with the strike price of $5 multiplied by 100 shares, we have a complete expenditure of $730. By the expiration date, JOBY stock should hit $7.30 based on the average price target. Therefore, assuming no time value remains, you can break even. However, it gets more interesting if you believe the high-side price target will be hit within 12 months.

Assuming that happens, then shares may land at $8.73 in October. If so, the profit for the trader would be $143. Should you have high confidence and want more returns, you can always buy more of the call option.

Still, when it comes to the stock’s unusual options activity, the best call option to buy (in my view) is the JOBY Jan 17 ’25 2.50 Call. At the time, this contract closed at $3.96. By the January expiration date, JOBY stock should be worth $7.85 per share. Multiply the contract, strike, and analysts projection by 100, and you have numbers that reflect a profit of $139.

Not only that, but if the maximum price target lands, you could pocket a profit of $322. Again, that’s assuming that the Street’s projections materialize in a linear fashion. If the upside projections occur earlier, you may have the opportunity to sell the call itself at a nice premium.

Watch the Downside Risk

Of course, you must be aware of the downside risks. After all, everyone gets things wrong in the market, even the experts. Here, TipRanks reports that the lowest price target sits at $6. Projecting out to January, JOBY stock, under a bearish framework, may be worth only $6.03.

If so, the risk of buying the aforementioned January call is a payment of $646, subtracted from the total value of the JOBY stock holdings, or $603. Overall, you would be looking at a loss of $43, which isn’t terrible.

This dynamic also brings up the point that you shouldn’t be afraid of buying deep-in-the-money (ITM) calls. Essentially, the intrinsic value of the option provides some insurance so long as the open-market price doesn’t fall below the strike price.

And yes, you can buy a higher-strike call. However, the risk in that case is that your option can expire with no time value or intrinsic value.

Is JOBY Stock a Buy, According to Analysts?

Turning to Wall Street, JOBY stock has a Moderate Buy consensus rating based on one Buy, one Hold, and zero Sell ratings. The average JOBY stock price target is $8.00, implying 29% upside potential.

The Takeaway: JOBY Stock Call Options Offer an Alternative Path

While the derivatives market can be daunting, the arena also offers a distinct path to profit from Joby Aviation’s compelling eVTOL narrative. By identifying opportunities based on complete option cost and assuming no time value remains, investors are better able to identify truly enticing deals. Further, by buying option contracts with significant intrinsic value, market participants may be better able to protect themselves from time decay (when an option loses extrinsic value as it gets closer to expiration).