SoFi Technologies (NASDAQ:SOFI) has been on quite a winning streak, with Q2 2025 ushering in a series of record highs for the fintech company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Among the new peaks, adjusted net revenues grew 44% year-over-year to reach $858 million while Adjusted EBITDA rose 81% to $249 million. Underpinning both, SOFI’s customers are growing by leaps and bounds. The company attracted 850,000 new members last quarter, which represented an increase of 34% year-over-year.

Its share price is up 155% during the past six months. With a track record like that, it’s fair to ask whether this momentum is sustainable.

Count top investor Michael Wiggins De Oliveira among those who believe in SOFI’s long-term growth story.

“SoFi isn’t just another flashy meme-like fintech story: it’s a fast-growing business that’s now proving its financial maturity,” explains the 5-star investor, who is among the top 3% of stock pros covered by TipRanks.

While avoiding any sort of prediction regarding future interest rates, Wiggins De Oliveira points out that easing rates would create a “big boost” for SOFI’s lending. He notes that this could provide a strong tailwind for the company’s revenues, pushing them beyond 25% year-over-year growth for 2026.

In that vein, the investor is extremely pleased by the company’s loan underwriting, citing SOFI’s fifth consecutive quarter of falling delinquency rates for personal loans.

“This is absolutely key and tells me that SOFI is a serious business, that is more than just a meme stock,” emphasizes Wiggins De Oliveira.

Moreover, the investor is encouraged by SOFI’s work in “hot areas” such as blockchain money transfers and crypto trading. Coupled with the strong revenue growth and an improved balance sheet following a recent capital raise, Wiggins De Oliveira believes that SOFI is on the march towards sustained profitability.

The investor does acknowledge SOFI’s high levels of retail ownership, which could make its share price particularly exposed to some volatility going forward. Though this is not an investment for the faint of heart, Wiggins De Oliveira remains undeterred.

“I’m fully focused on staying patient long enough to let this inflection story play out,” sums up Wiggins De Oliveira, who rates SOFI a Strong Buy. (To watch Michael Wiggins De Oliveira’s track record, click here)

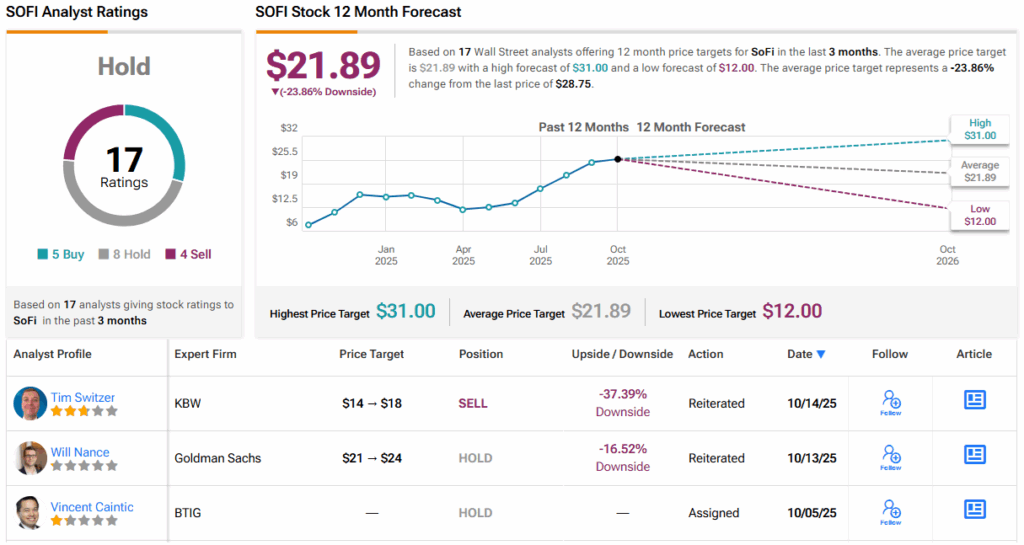

Wall Street isn’t quite as enthusiastic. With 5 Buys, 8 Holds, and 4 Sells, SOFI carries a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $21.89 implies losses of ~24%. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.