The days when EVs were the shiny new thing are really not that long ago, but in stock market terms, those times feel like something of a bygone era. Recent times have seen the industry struggle amidst intense competition and waning demand, and have affected even the sector’s biggest operators.

But while the big fish such as Tesla are probably well-equipped to weather the storm, smaller operators trying to make it through are having a hard time doing so. Just ask Fisker (NYSE:FSR). Along with recently delivering a disappointing Q4 report, the company voiced concerns about its ability to sustain operations. The company cited a challenging year marked by elevated interest rates and not being able to deliver the Ocean SUV as quickly as it wanted to.

Obviously, that didn’t go down well with investors who have been turning away in droves. To wit, shares have been completely obliterated as of late, falling by a huge 81% since the turn of the year.

So, what’s to be done to avoid catastrophe? The EV maker stated that it is in talks with a current investor regarding the potential for additional investment. Moreover, as part of its cost-cutting efforts, Fisker plans to reduce its workforce by 15%. Meanwhile, there have also been reports that the company is having discussions with Japan’s Nissan Motor, who could potentially invest up to $400 million.

Fisker has also changed its overall strategy. It initially adopted a business model resembling Tesla’s, focusing on direct sales to customers without intermediary dealers. However, the company has now completely transitioned away from its direct-to-consumer model, citing interest from over 250 dealers to carry their brand. Nevertheless, so far they have only onboarded fewer than 20 dealerships, with management hinting at more announcements to come.

Assessing this new game plan, Needham analyst Chris Pierce is uncertain it will work.

“It’s hard to know if this is a long term solution given how little we know about FSR end demand, and what we do know has not been overwhelmingly positive,” the analyst said. “Dealers buying inventory is a clear benefit to FSR’s economics and model, but dealers selling this inventory to consumers and reloading their lots is much harder to gauge.”

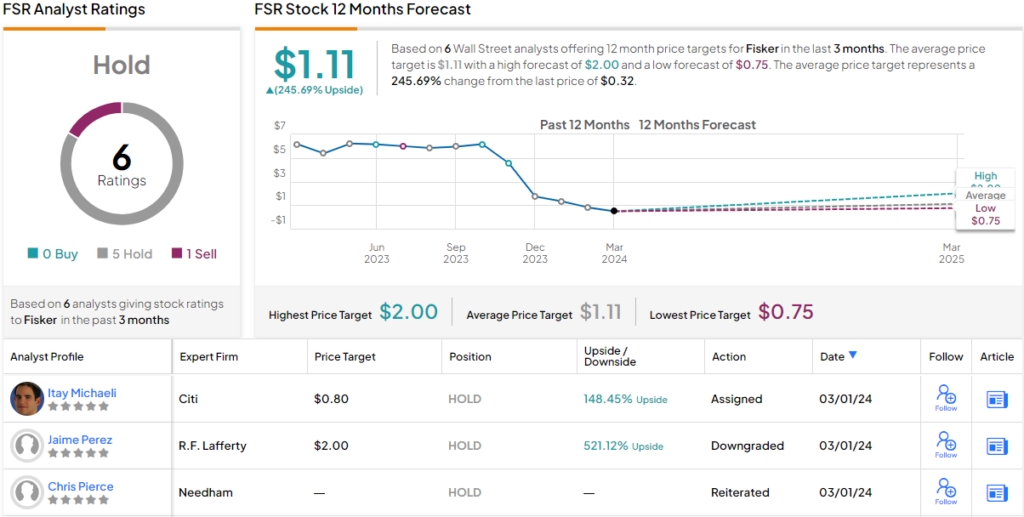

All told, for now, Pierce reiterated a Hold (i.e., Neutral) rating on FSR shares although the analyst has no fixed price target in mind. (To watch Pierce’s track record, click here)

Meanwhile, when it comes to Fisker’s flagship Ocean vehicle, Cowen analyst Jeffrey Osborne sees some potential. He thinks its cheaper price tag could make a splash in the EV market. Yet, even he’s not ready to go all in.

“Fisker’s flagship Ocean vehicle has experienced many growing pains, which we believe once rectified, could position it to be a share gainer within the EV market given its more affordable starting price. However, given the growing pains endured recently, we are comfortable on the sidelines until steady execution is demonstrated,” Osborne opined.

To this end, Osborne rates Fisker shares a Market Perform (i.e., Neutral). But Osborne might as well have said ‘buy’ — because the analyst thinks the stock, currently at $0.32, could zoom ahead to $1 within a year, delivering 212% gains. (To watch Osborne’s track record, click here)

Overall, a look at the Street’s assessment of Fisker is a tad disorientating. On the one hand, based on a mix of 5 Holds and 1 Sell, the analyst consensus rates the stock a Hold. That said, most seem to think the shares are now severely undervalued; at $1.11, the average target suggests the stock is set to triple in value over the next 12 months. (See Fisker stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.