Sometimes, not even a little extra help from analysts can push a stock out of the doldrums. Just ask electric vehicle stock Fisker (NYSE:FSR), who received praise from CRFA analysts yet still slid over 4% in Friday afternoon’s trading on terrible news about new federal probes.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

The word from CFRA was pretty positive for Fisker, as it boosted the rating from Sell to Hold. Analyst Garrett Nelson pointed out that Fisker has seen a huge drop in share prices, which might make for a good potential entry point. However, he also noted that it might be too risky a play, hence the Hold rating. Nelson suggested that the “easy profits” have been made already shorting Fisker, and with around 44% of the float still leaning short, Fisker shares could prove a lot more volatile than anyone really wants to deal with right now.

But It Doesn’t Get Better

While this is kind of a mixed bag of good news—or at least is good news of limited impact—the rest of the story for Fisker isn’t good. The National Highway Traffic Safety Administration (NHTSA) is taking aim at Fisker over a matter of braking. The 2023 Ocean crossover, reports note, is looking into nine complaints about braking in the Ocean, including one that ended in injury.

Reports note that the Ocean suffers from a “…partial loss of braking over low-traction surfaces,” and Ocean’s regenerative braking system isn’t working quite up to snuff either. The investigations, of course, will get to the bottom of that, but Fisker doesn’t need bad press of any sort right now.

Is Fisker a Buy, Sell, or Hold?

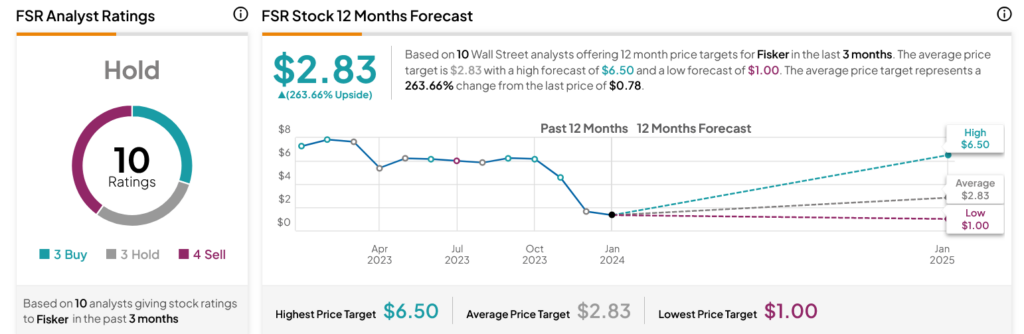

Overall, Wall Street analysts have a Hold consensus rating on FSR stock based on three Buys, three Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 88.55% loss in its share price over the past year, the average FSR price target of $2.83 per share implies 263.66% upside potential.