Shares of electric vehicle manufacturer Fisker (NYSE:FSR) fell for the second day in a row, down nearly 9% in Wednesday afternoon’s trading. In addition, the short-sellers are piling on, as short interest has reached 42% of the total float. Troubles began for Fisker when it offered an update on its overall production levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fisker put together 10,142 vehicles in 2023, and deliveries started up in earnest with June, ramping up into fall’s arrival. So far, it’s delivered roughly 4,700 vehicles, most of which were Fisker Ocean One models, with each one priced at $68,999. Several issues are cropping up for Fisker, including profitability issues and overall corporate momentum. However, there is still a chance, some analysts project, that Fisker may ultimately be one of the last electric vehicle upstarts still standing as the market shakes itself out.

Fisker’s Financial Numbers Look Distressing

Those projections may prove somewhat optimistic. Just looking at the numbers is distressing; its production-to-sales ratio is a little over two to one right now, meaning that Fisker likely has quite a bit of inventory on hand. And inventory that’s selling at nearly $70,000 a crack right now may not go over so well for folks who are buying groceries on installment plans.

It gets worse, though; a class action lawsuit is already in the works via Levi & Korsinsky. That’s in addition, apparently, to the one currently running with Holzer & Holzer LLC. However, word that the company is slashing production likely won’t hurt, and there’s no doubt its deliveries are on the rise, so at least it’s moving in the right direction.

What is the Target Price for Fisker?

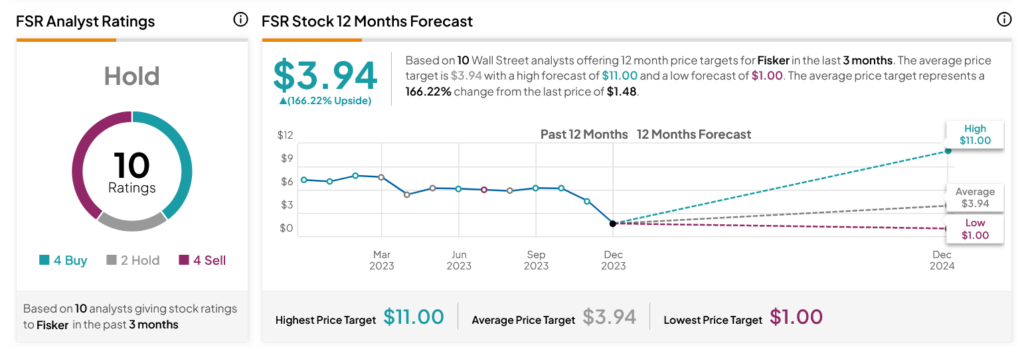

Turning to Wall Street, analysts have a Hold consensus rating on FSR stock based on four Buys, two Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 79.59% loss in its share price over the past year, the average FSR price target of $3.94 per share implies 166.22% upside potential.