Shares of electric vehicle (EV) startup Fisker (NYSE:FSR) dropped about 47% in Wednesday’s after-hours trading on news of a potential bankruptcy. Per a Wall Street Journal report, Fisker has hired restructuring advisers, including financial adviser FTI Consulting and the law firm Davis Polk, to assist with the bankruptcy filing.

This shouldn’t be a surprise, as the company’s CFO, Geeta Gupta-Fisker, warned during the Q4 conference call that there is substantial doubt over the company’s future viability. She noted that the current resources won’t be sufficient to cover the company’s financial needs over the next 12 months, and Fisker may need to seek additional equity or debt financing.

She emphasized that insufficient financing might force a cutback in planned investments, potentially impacting product development, headcount, and the production of their flagship product, the Ocean SUV.

Factors Behind Fisker’s Downfall

Fisker stock is down about 95% in one year. This staggering decline is attributed to its struggle to expand sales. Like other EV manufacturers, the company faced headwinds from elevated interest rates, which dampened consumer demand.

Additionally, Fisker struggled to establish a direct-to-consumer (DTC) sales model in North America and Europe. Moreover, insufficient skilled labor and difficulties in securing suitable real estate locations to make its DTC model function further remained a drag.

Fisker transitioned to the Dealer Partner model this year to boost volumes. Nevertheless, the company has not yet acknowledged any notable acceleration in sales.

Is Fisker a Buy, Sell, or Hold?

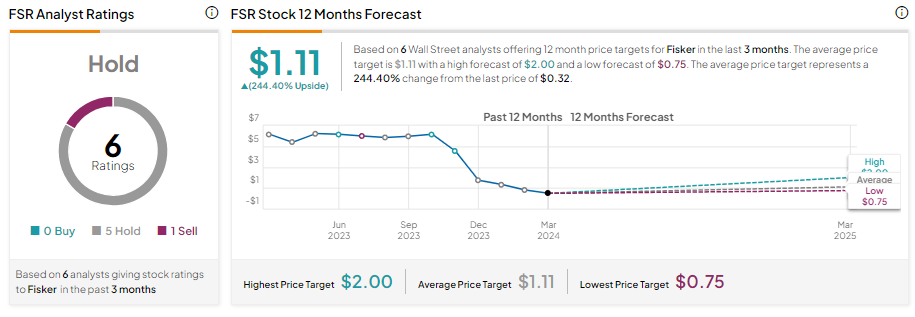

Given the ongoing headwinds, Wall Street remains sidelined on Fisker stock. Five out of six analysts covering FSR stock recommend a Hold, and one maintains a Sell. Overall, Fisker stock sports a Hold consensus rating.

Analysts’ average price target on FSR stock is $1.11, implying an upside potential of 244.4%.