Errors are inevitable in life. That’s why, after all, pencils have erasers, and keyboards have delete keys. But when lawmakers discovered a huge pile of billing errors in the last year alone, that put some student loan companies on the hot seat. Indeed, Navient (NASDAQ:NAVI) was down nearly 3% in Wednesday afternoon’s trading thanks to its part in the pile.

Lawmakers found a whopping 3.9 million “billing-linked errors” in the course of the last year. That’s when student loan payments started back up, and a recent study from the Department of Education and a string of servicer audits found that four of the biggest student loan servicing operations in the U.S. had nearly one million errors apiece between them, on average.

The lawmakers in question—Senators Chris Van Hollen, Ed Markey, Elizabeth Warren, and Richard Blumenthal—noted that Navient and its contemporaries were under contract with the federal government at the time yet still made the huge list of errors. With an ongoing controversy over student loan repayment going on, errors like this may be helpful for lawmakers looking to cancel or otherwise forgive said debt.

A Positive Business Model…for Now

This revelation will likely prove troubling, as it will almost certainly be used like a goad to get some politically expedient loan forgiveness measures in play. Navient has long done well based on its combination of in-school loan origination and its ability to generate recurring revenue. Throw in some cost-control measures, and the loan repayments that come in give it plenty of solid cash flow. While there are some concerns—particularly about limits in growth and the potential for government intervention in its business model—the end result should still prove solid, barring more of that government intervention.

Is Navient a Good Stock to Buy?

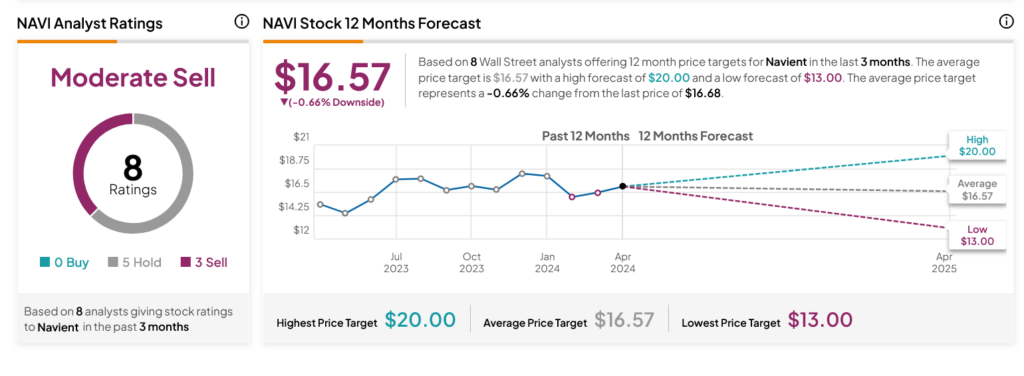

Turning to Wall Street, analysts have a Moderate Sell consensus rating on NAVI stock based on five Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 7.67% rally in its share price over the past year, the average NAVI price target of $16.57 per share implies 0.66% downside risk.