FedEx Corporation’s shares jumped 4.4% in Thursday’s extended trading session as the American multinational delivery services company’s fiscal third-quarter (ended Feb. 28) results surpassed analysts’ expectations. Strong top-line growth, aided by volume growth in US domestic residential package and FedEx International priority services, was the primary driver.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

FedEx’s (FDX) 3Q adjusted earnings more than doubled to $3.47 per share on a year-over-year basis and easily beat Street estimates of $3.24 per share. Revenue increased 23% to $21.5 billion and came in well ahead of analysts’ expectations of $19.96 billion.

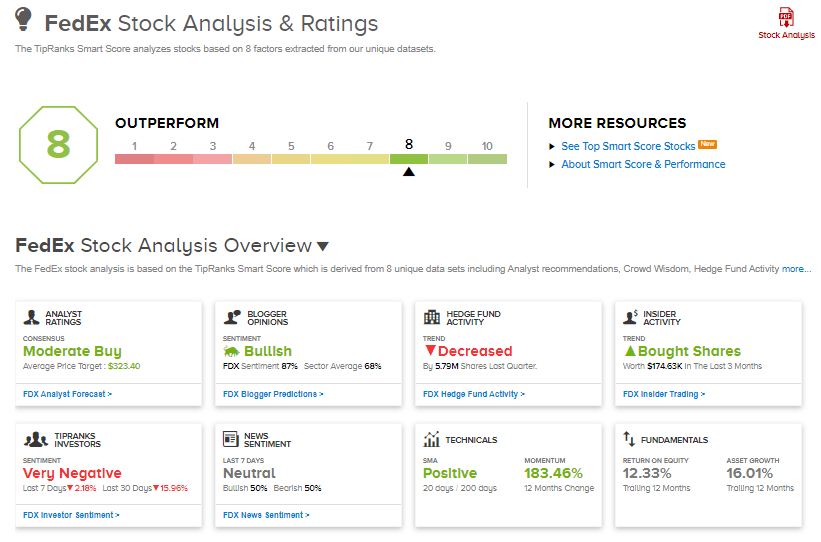

The company’s operating margin was 4.9% in the quarter, up from 2.8% in the prior-year quarter. (See FedEx stock analysis on TipRanks)

FedEx CEO Frederick W. Smith commented, “We expect demand for our unmatched e-commerce and international express solutions to remain very high for the foreseeable future.”

For fiscal 2021, the company expects EPS to be in the range of $17.60 to $18.20.

On March 12, Credit Suisse analyst Allison Landry decreased the stock’s price target to $350 (32.8% upside potential) from $368 and maintained a Buy rating.

“While margins are typically a focal point of earnings,” Landry thinks “investors will be willing to forgive higher cost/piece inflation so long as improved revenue/piece is sufficient to suggest that core price is going up/surcharges are sticking.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 13 Buys, 4 Holds, and 1 Sell. The average analyst price target of $323.40 implies 22.7% upside potential to current levels. Shares have increased 10.4% over the past six months.

FedEx scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Lennar’s 1Q Results Top Analysts’ Expectations As Housing Market Picks Up

Johnson & Johnson’s Single-Dose COVID-19 Vaccine Granted Emergency Use Listing By WHO

CDW Inks Deal To Buy Amplified IT; Street Says Buy