In the recent round of annual stress tests, all 23 American banks tested by the Federal Reserve displayed resilience to a hypothetical severe economic recession, continuing to meet minimum capital standards and lend, according to the regulator’s Wednesday report. This included major banks like JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), and Bank of America (NYSE:BAC). The testing scenarios included a 10% spike in unemployment, a 40% plunge in commercial real estate prices, and a 38% fall in housing prices, simulating a severe global recession.

The results, however, aren’t an outright endorsement of the banking system’s stability, as recent regional bank failures, potential regulatory changes, and international standard tightening loom. Moreover, for the first time, the Fed applied an experimental market shock to the largest banks’ trading books to assess resilience to inflationary pressures and rising interest rates. Although the findings of this exploratory procedure won’t affect the banks’ capital requirements, they provided critical insights into trading risks under adverse conditions.

Michael Barr, the Fed’s Vice Chair for Supervision, highlighted that while the banking system appears robust, it’s vital to stay vigilant to emerging risks. Banks will announce their updated capital plans, including buybacks and dividends, by Friday, with expectations of a conservative approach due to potential recession risks and regulatory uncertainties.

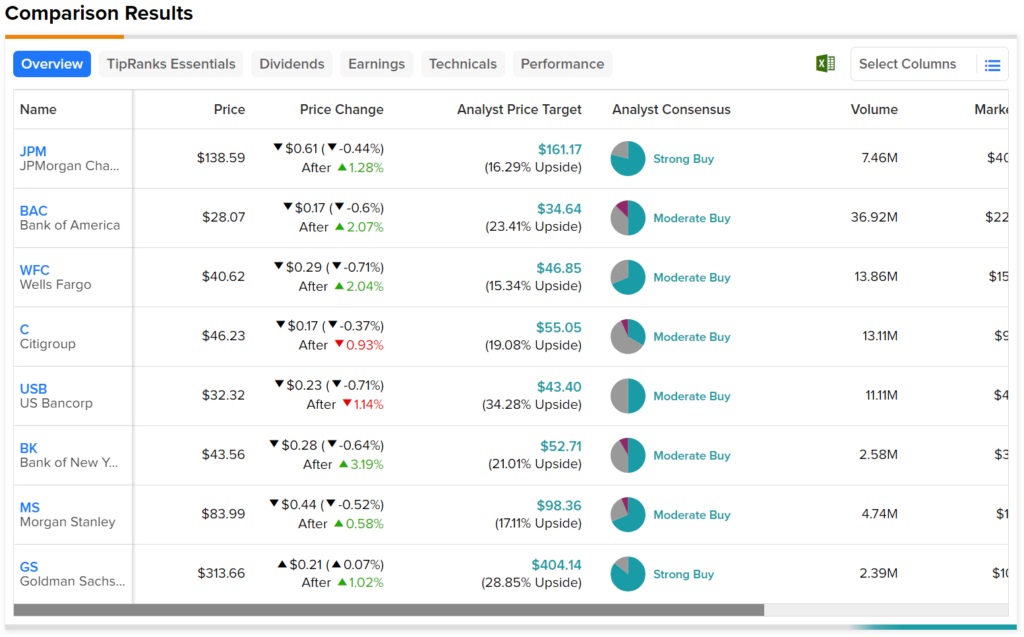

Nevertheless, investors appear to be enthusiastic about the results as most bank stocks jumped in after-hours trading.