Federal Reserve Governor Stephen Miran, who was recently appointed to the U.S. central bank by President Donald Trump, is calling for a 50-basis-point interest rate cut in October.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In media interviews, Miran said he plans to repeat his push for a half-percentage-point interest rate cut when the Fed next meets on Oct. 29. However, Miran conceded that he still expects his colleagues at the Fed to vote for another quarter-point (25-basis-point) interest rate reduction.

“My view is that it should be 50 (basis points),” he said during a television interview. “However, I expect it to be an additional 25 and I think that we’re probably set up for three 25-basis-point cuts this year, for a total of 75 basis points.” Miran is viewed as having been placed at the U.S. Federal Reserve to push President Trump’s agenda that calls for much lower interest rates to stimulate economic growth.

Differing Views

Other Federal Reserve governors are already disagreeing publicly with Miran’s viewpoint. Governor Christopher Waller said the central bank should lower interest rates at a more measured pace due to signs of a weakening U.S. labor market and heightened geopolitical tensions.

In a speech delivered in New York City, Waller pushed for a quarter-percentage-point reduction at the central bank’s meeting later this month, a position that appears more in line with consensus at the Fed. Central bank officials have been operating in a quandary that involves a standstill in hiring and sticky inflation that’s been exacerbated by President Trump’s tariffs.

“Based on all of the data we have on the labor market, I believe that the (Fed) should reduce the policy rate another 25 basis points at our meeting that concludes Oct. 29,” Waller told the Council on Foreign Relations. The Federal Reserve next meets Oct. 29, with markets pricing in a nearly 100% chance of a 25 basis point interest rate cut.

Is the SPDR S&P 500 ETF Trust a Buy?

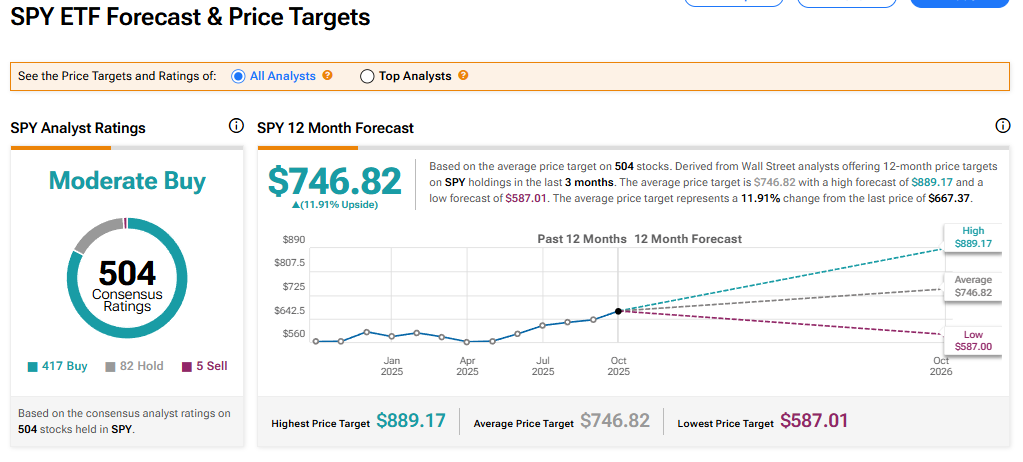

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 417 Buy, 82 Hold, and five Sell recommendations issued in the last three months. The average SPY price target of $746.82 implies 11.91% upside from current levels.