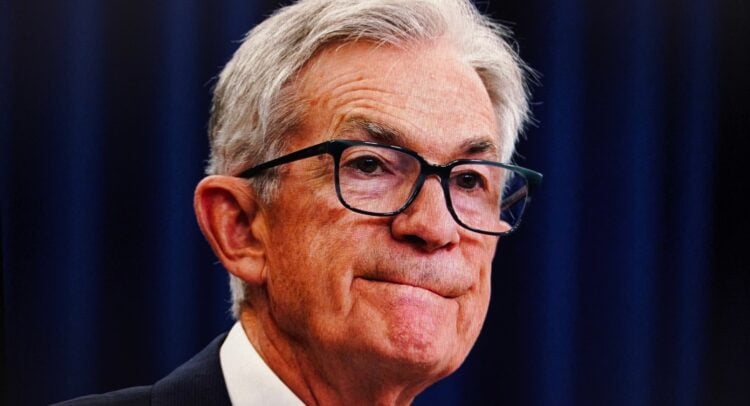

In a speech delivered to the National Association for Business Economics’ conference in Philadelphia, Federal Reserve Chair Jerome Powell said there is “no risk-free path” for monetary policy going forward.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Powell was referring to the tension that exists between the central bank’s dual goals of maximum employment and keeping inflation at an annual rate of 2%. The central bank chair said the challenges facing the Fed are great, adding that the delay of the release of key economic data due to the ongoing government shutdown in Washington, D.C. is further complicating matters.

“Based on the data that we do have, it is fair to say that the outlook for employment and inflation does not appear to have changed much since our September meeting four weeks ago,” Powell said. “Data available prior to the shutdown, however, show that growth in economic activity may be on a somewhat firmer trajectory than expected.”

Balance Sheet Focus

The Fed chair used most of his speech and related comments to discuss where the U.S. central bank stands with “quantitative tightening,” or the effort to reduce the more than $6 trillion in securities it holds on its balance sheet.

While he provided no specific date for when the quantitative tightening program might end, he said there are indications that the Fed is nearing its goal of “ample” reserves available for U.S. banks. “Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions… We may approach that point in coming months.”

The U.S. Federal Reserve’s next decision on interest rates is scheduled for Oct. 29. Futures markets are pricing in a 96.7% chance that the central bank will lower interest rates by another 25 basis points.

Is the SPDR S&P 500 ETF Trust a Buy?

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 420 Buy, 78 Hold, and six Sell recommendations issued in the last three months. The average SPY price target of $733.65 implies 11.33% upside from current levels.