Nvidia (NASDAQ:NVDA) stock has had a topsy-turvy ride in 2025, bouncing up and down like a yo-yo. Although it rebounded 48% from its post–Liberation Day lows, it’s still just flat for the year.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

What’s been weighing it down? A barrage of headwinds: investor nerves over DeepSeek’s rise, fresh U.S. export restrictions on AI chips to China, and whispers that the hyperscalers might be dialing back their capex budgets.

On top of that, trade-related tensions have cast a shadow over the broader market, weighing on growth forecasts and rattling investor sentiment. Lately, though, the tone has shifted – with the U.S. and China softening their stance, some of the heat is coming off.

Even Cavenagh Research – a top investor who once sounded the alarm on Nvidia – is changing his tune, admitting that fears of Nvidia’s impending losses proved to be way overblown.

“With investor sentiment hitting a low in May, I expect a recovery in the second half of 2025, supported by strong underlying fundamentals,” writes Cavenagh, who is among the top 4% of TipRanks’ stock pros.

Backing his revised stance, Cavenagh highlights that the fears of slashed AI spending were largely misplaced. According to investor, the major hyperscalers – Meta, Google, Microsoft, and Amazon – are not only staying the course but even ramping up their AI investment plans. Since February 2025, shortly after the DeepSeek story broke, there’s actually been a slight uptick in spending projectio.

That optimism is echoed in analyst forecasts as well. Nvidia’s Q1 FY 2026 revenues are expected to hit $43 billion – a 63% jump year-over-year. And while gross margins may have edged down, Cavenagh believes the strength in top-line growth should more than make up for it.

Going forward, Cavenagh will be paying attention to the Blackwell ramp, margin trends, and indications for how 2026 will be shaping up. Through it all, continuing AI demand should be just the ticket to deliver growth up ahead.

That said, even with the skies clearing, Cavenagh isn’t rushing in. While no longer bearish, the investor content to stay neutral for now, issuing a Hold rating on NVDA shares as he waits to see how the second half of 2025 unfolds. (To watch Cavenagh Research’s track record, click here)

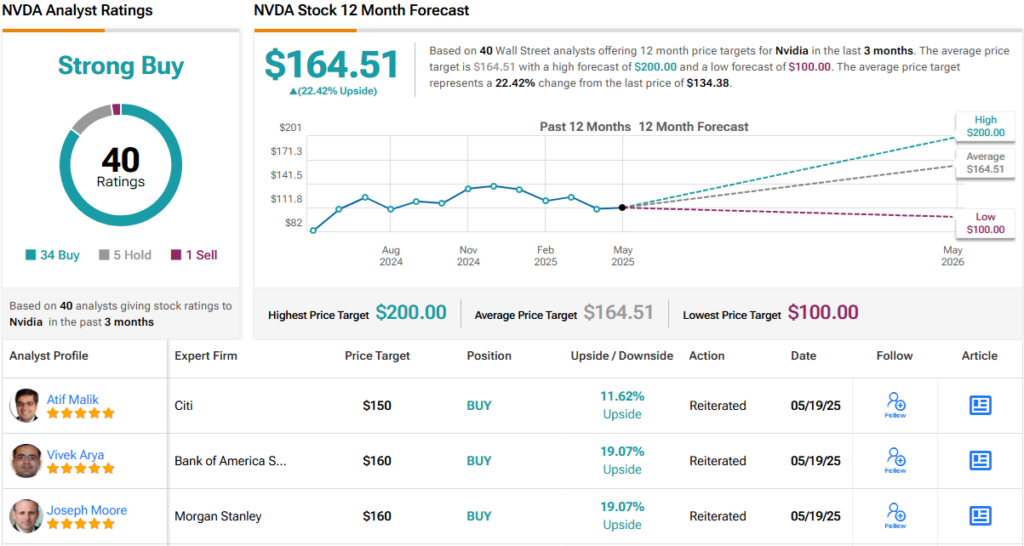

Wall Street, on the other hand, is still all-in on the Nvidia story. With 34 Buys, just 5 Holds, and a lone Sell, the stock boasts a Strong Buy consensus rating. Analysts are targeting a 12-month average price of $164.51, suggesting there’s ~22% upside from current levels. (See NVDA stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.