The U.S. Food and Drug Administration has classified Abbott’s (NYSE:ABT) recall of the FreeStyle Libre, Libre 14 day, and Libre 2 Flash continuous glucose monitoring system (CGM) readers as a Class I recall, which is “the most serious type of recall.” The FDA warned that the use of these recalled devices “may cause serious injuries or death.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Abbott initiated a “voluntary medical device correction to emphasize instructions” for the use of readers in certain glucose monitoring systems in the U.S., as it received a “limited number” of reports worldwide (0.0017%) from users over several years highlighting battery-related issues. The recall affects over 4.2 million devices distributed from November 2017 to February 2023.

These readers, which use rechargeable lithium-ion batteries, have been recalled due to the possibility of overheating, spark or fire when they are charged with non-Abbott adapters or USB cables. This is because unlike Abbott-provided USB cables and power adapters that limit the current needed to safely charge the battery, third-party cables and adapters might allow higher power, increasing the risk of fire.

Additionally, the misuse (like exposure to liquids, damage, and introduction of foreign material into the ports) of these readers and their components might also cause harm. The FDA noted that Abbott has reported 206 incidents related to this issue, including at least seven fires and one injury. No deaths have been recorded.

Potential Impact of Product Recalls

Abbott’s Libre CGMs are considered to be one of the company’s key growth drivers. The company expects Libre to be a $10 billion product in the next five years, which reflects an annual growth rate of about 15%. Abbott’s Libre recall might raise questions about the credibility of this key product line and benefit rivals in the CGM space like Dexcom (DXCM) and Medtronic (MDT).

Last year, Abbott’s business was hit by the voluntary recall of certain infant formula products due to unsanitary conditions at its Sturgis, Michigan plant. The company is facing multiple lawsuits and investigations by the Securities and Exchange Commission (SEC) and the Federal Trade Commission (FTC) in this matter.

Is Abbott Labs a Buy, Sell, or Hold?

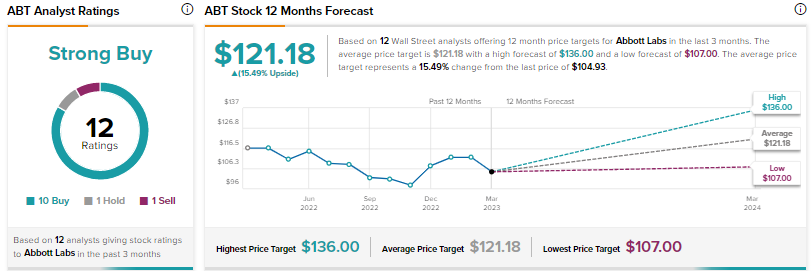

Wall Street has a Strong Buy consensus rating on Abbott stock based on 10 Buys, one Hold, and one Sell. The average price target of $121.18 implies 15.5% upside. Shares have declined 4.4% year-to-date.