Abbott Laboratories’ (NYSE:ABT) infant formula business is still on the radar of regulators. The company’s recent SEC filing reveals that the Securities and Exchange Commission (SEC) and Federal Trade Commission (FTC) are investigating some of its products.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company said that the FTC started a civil investigation in January 2023. The regulator requested information from Abbott in relation to an ongoing investigation of companies that bid for the WIC (Women, Infants, and Children) program. This federal program provides nutritional items, including baby formula, at no cost, to low-income families.

In addition, the SEC requested that Abbott provide information about its powder infant formula business and related public disclosures last December. The investigations came after the U.S. Department of Justice began a criminal inquiry on Abbott’s Sturgis infant formula manufacturing plant, in November 2022.

It is worth mentioning that as of the end of January, Abbott faced about 399 lawsuits involving its specialty formula products for preterm infants. These lawsuits claim that a disease called necrotizing enterocolitis developed among preterm infants and resulted in personal injuries or death.

ABT Risk Factors Abound

Indeed, Abbott reported six changes to its risks in its most recent SEC report. According to TipRanks’ Risk Factors page, Abbott’s legal and regulatory risks are above the sector average.

Moreover, TipRanks’ graph of ABT’s risk factors over time shows a significant rise.

Is ABT a Good Stock to Buy?

Abbott’s near-term performance remains impacted by its involvement in several legal issues and tanking revenues due to lower demand for COVID tests.

At the same time, the company has an impressive dividend history as it raised dividend amounts annually over the past years. Furthermore, Abbott has several new products in the pipeline which it expects to support top-line growth.

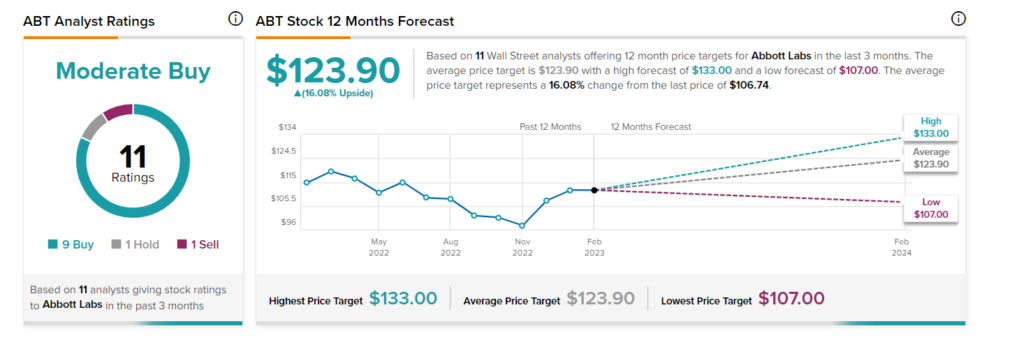

Even more, analysts are optimistic about ABT stock. Abbott has a Strong Buy consensus rating based on nine Buy, one Hold, and one Sell recommendations. The average price target of $123.90 implies upside potential of 16.1% from the current level. Shares of the company have gained 3.2% over the past three months.