Energy firm Exxon Mobil (XOM) has signed a new agreement with Iraq to help develop the massive Majnoon oilfield. The non-binding deal was announced during a visit by Iraqi officials and follows similar agreements with other oil companies. Iraq, which holds some of the world’s largest oil and gas reserves, hopes to increase its current oil production from 4 million barrels per day (bpd) to over 6 million bpd by 2029. However, challenges like bureaucracy, infrastructure limitations, and years of conflict have slowed progress.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, the Majnoon field, located near Basra in southern Iraq, is one of the biggest in the world, as it holds an estimated 38 billion barrels. According to oil analyst Muwafaq Abbas, the deal shows that Iraq is pushing to modernize its energy sector and improve its ties with the U.S. In addition, the agreement includes profit-sharing on both crude oil and refined products, as well as upgrades to Iraq’s oil export facilities in the south.

Iraq’s state oil company SOMO is also expected to partner with Exxon in order to secure oil storage capacity in Asia. Notably, Exxon was one of the first Western oil firms to enter Iraq after 2003, but left the West Qurna 1 project due to low returns. It also exited projects in Kurdistan for similar reasons. Now, as Iraq restarts crude exports through Turkey—following a 2023 suspension—it could add up to 230,000 bpd back into global markets. This comes as OPEC+ producers, including Iraq, work to increase output and gain a larger share of the international oil market.

Is XOM Stock a Good Buy?

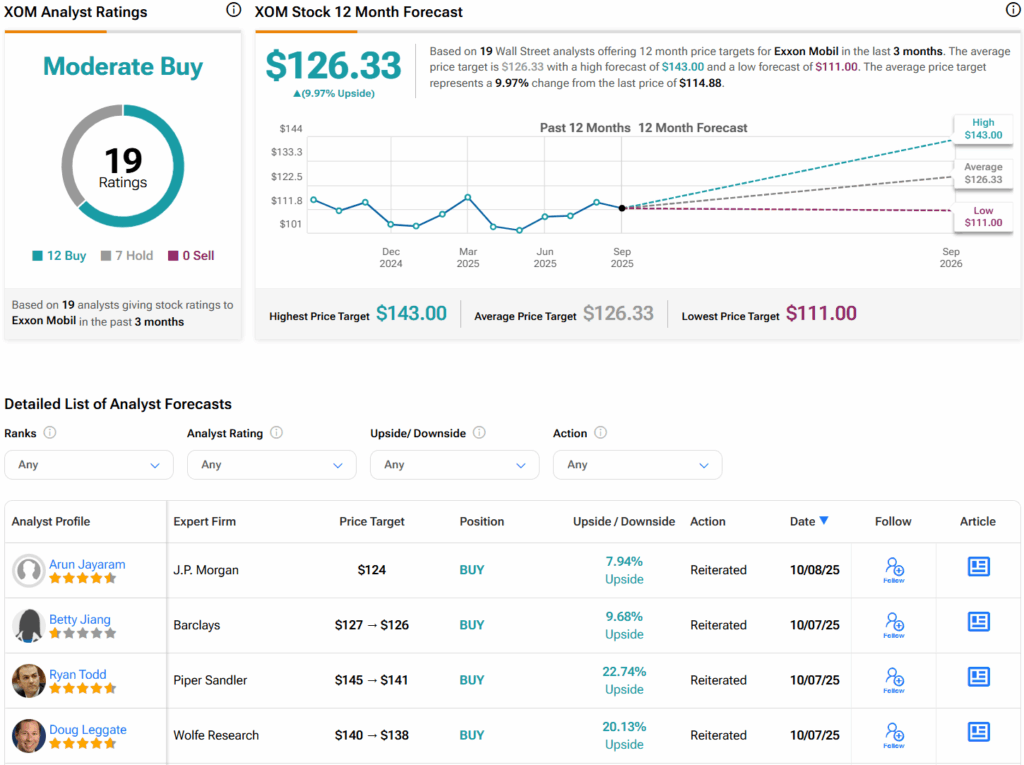

Turning to Wall Street, analysts have a Moderate Buy consensus rating on XOM stock based on 12 Buys, seven Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average XOM price target of $126.33 per share implies 10% upside potential.