Exxon Mobil (NYSE:XOM) has taken legal action against two environmentally-focused investors, Follow This and Arjuna Capital. The move comes after the investors proposed that XOM accelerate its greenhouse gas emission reduction targets. By suing investors, XOM aims to exclude these proposals from the agenda of its upcoming annual shareholder meeting.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

In its lawsuit, XOM alleged that the proposals put forth by both activist investors have the potential to adversely impact its current operations. Furthermore, XOM contended that these proposals do not promote long-term shareholder value.

Referring to regulations set forth by the U.S. Securities and Exchange Commission (SEC), Exxon Mobil claims that it can exclude the proposals from its proxy statement as they concern its ordinary business operations. Also, these proposals closely resemble ones previously put forth and voted on within the last five years, thereby not requiring reconsideration.

Is XOM Stock a Buy or Sell?

With increasing pressure from ESG investors for more aggressive climate action, Exxon Mobil’s lawsuit is likely to be closely watched by other Wall Street companies.

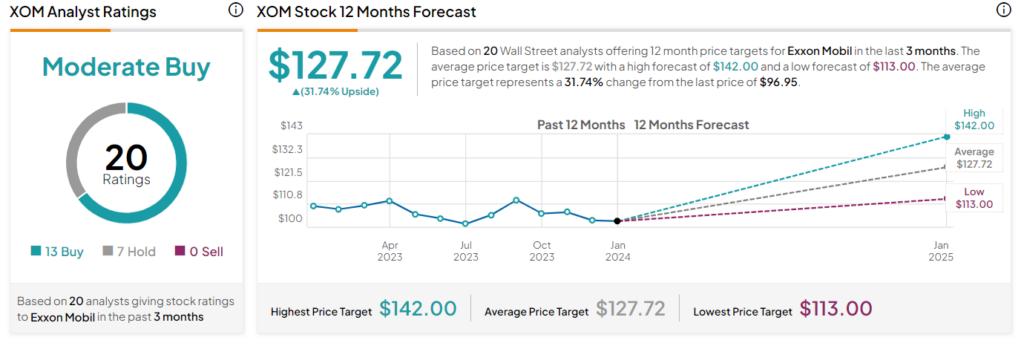

Overall, Wall Street analysts are currently cautiously optimistic about XOM stock with a Moderate Buy consensus rating based on 13 Buy and seven Holds assigned in the past three months. The average price target of $127.72 per share implies a 31.7% upside potential. Shares have declined 11.1% in the past year.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue