Energy major Exxon (NYSE:XOM) has stopped looking for oil in Brazil, according to the Wall Street Journal.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company has moved its teams out of Brazil to other geographies after its third attempt at striking oil in Brazil came up empty-handed. Exxon had been looking at the country as a potential area of major growth.

The development comes fresh after Exxon noted that its Q1 bottom line is expected to see an adverse impact from lower oil prices. The impact from lower oil prices on upstream earnings is estimated in the range of $600 million and $1 billion. Additionally, lower natural gas prices are also expected to impact its bottom line in the range of $400 million and $800 million.

Separately, the company’s CEO, Darren Woods, noted that Exxon’s low-carbon operations could exceed its oil and gas operations in the next 10 years. This means the company could be less susceptible to commodity price gyrations after this phase.

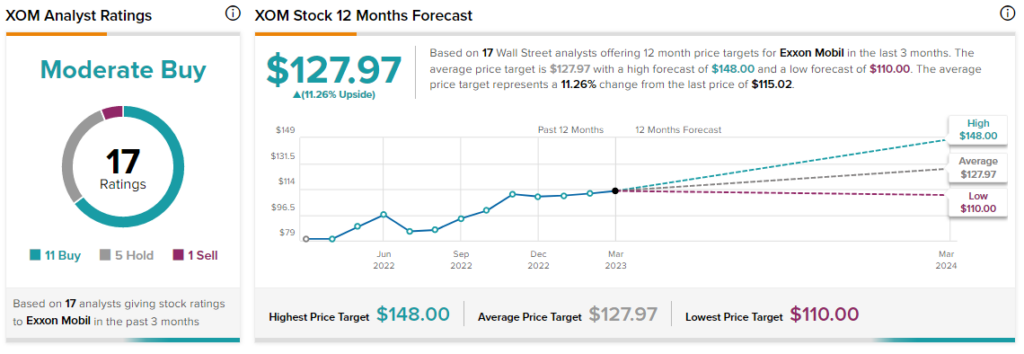

Overall, the Street has a $127.97 consensus price target on XOM, pointing to an 11.26% potential upside in the stock. That’s on top of a 38.3% surge in the share price over the past 52 weeks.

Read full Disclosure