Energy giant Exxon Mobil (NYSE:XOM) expects its first-quarter earnings to decline compared to the fourth quarter of 2022 due to lower oil and gas prices and certain other factors. The company estimates lower oil prices to drag down Q1 upstream earnings by $600 million to $1 billion, while lower natural gas prices are expected to have a $400 million to $800 million impact.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, Exxon expects changes in unsettled derivatives to pull down upstream earnings by $1.8 billion to $2.2 billion.

U.S. gas prices fell by more than half in the first quarter compared to Q4 2022, per Reuters. Further, global oil prices declined nearly 7% from Q4 2022 to an average of $82 per barrel in the first quarter. Nonetheless, oil prices are expected to move higher, driven by the recently announced production cuts by Saudi Arabia and other OPEC+ countries.

Exxon and other major oil and gas companies generated stellar profits last year due to elevated energy prices triggered by the Russia-Ukraine war. Exxon’s EPS jumped to $13.26 in 2022 from $5.39 in 2021. The company’s solid cash flows helped boost shareholder returns through $14.9 billion in dividends and $14.9 billion of share repurchases last year.

Looking ahead, Exxon is bullish about the prospects of its low-carbon business. As per an investor presentation, the company expects its low-carbon business to generate billions of dollars in revenue within the next five years and projects it to increase to hundreds of billions of dollars after a decade. On Tuesday, Exxon signed a long-term agreement with Linde (LIN) for the off-take of carbon dioxide associated with Linde’s new clean hydrogen production in Beaumont, Texas.

Is Exxon a Good Stock to Buy?

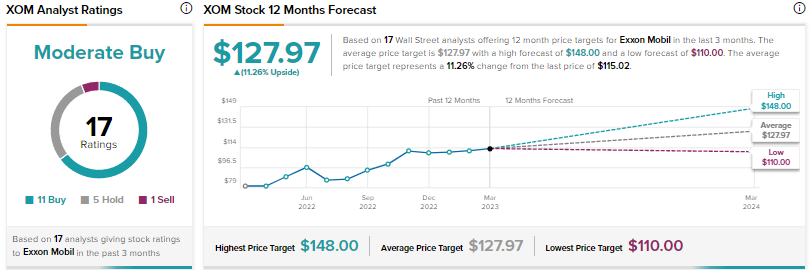

Wall Street’s Moderate Buy consensus rating for Exxon is based on 11 Buys, five Holds, and one Sell. The average XOM stock price target of $127.97 implies 11.3% upside potential. Shares have advanced over 4% since the start of 2023.