Shares of tech-based travel company Expedia (NASDAQ:EXPE) dropped over 13% in after-hours trading on Thursday. This decline was primarily due to concerns about the CEO transition plan, which overshadowed better-than-expected Q4 results. Ariane Gorin, who has been named as the new CEO, will assume her new role on May 13, 2024, succeeding Peter Kern. Kern has been the company’s CEO since 2020.

Adding to investors’ concerns, the company expects growth rates to decelerate due to the tough year-over-year comparisons. Moreover, the company expects price softness across various categories. Despite these challenges, the company foresees a relatively robust outlook for travel demand.

With this backdrop, let’s delve into the company’s Q4 performance.

Expedia: Q4 Sales and Earnings Beat Expectations

Expedia delivered revenue of $2.89 billion in Q4, up 10% year-over-year. Moreover, it exceeded analysts’ expectations of $2.87 billion. Its gross bookings totaled $21.67 billion, up 6% year-over-year. However, it came in lower than the analysts’ expectations of $22 billion.

Meanwhile, the company delivered adjusted earnings of $1.72 per share, which increased 37% year-over-year and surpassed analysts’ average estimate of $1.67. Higher sales and operating efficiency supported the company’s bottom-line growth.

Looking ahead, Expedia expects its gross bookings to grow by low to mid-single digits in Q1. Further, its top line is projected to record mid-single-digit growth.

Is EXPE a Buy, Sell, or Hold?

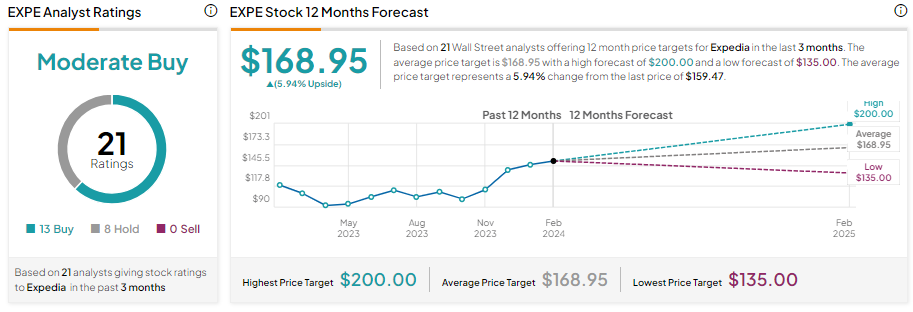

Expedia stock has gained over 35% in one year. Given this notable gain in its share price, Wall Street analysts are cautiously optimistic about EXPE stock.

It has 13 Buy and eight Hold recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $168.95 implies 5.94% upside potential from current levels.