The good news about chip stock Intel (INTC) is that it seems to understand, and quite thoroughly, one of the biggest stumbling blocks it labors under today. Specifically, it labors under the desperate need for new revenue streams. And it may be a little closer to getting some of these with a new alliance with TurinTech that will provide a whole new set of options for the AI PC market. That proved welcome for shareholders, who sent Intel shares up nearly 2% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new arrangement will bring Artemis, an AI engineering platform made by TurinTech, to Intel hardware. Better yet, Artemis will run entirely on-device, which means the hardware does not need an internet connection to operate Artemis, reports note. With Intel’s XPU architecture and OpenVINO integration, Artemis uses the various processor resources to deliver high performance, while keeping other devices free.

Intel’s senior director and general manager of AI PC developer relations, Dennis Luo, noted, “Through our collaboration, we’re making it easier to bring Artemis directly on-device, empowering developers to tap into Intel platform capabilities with greater efficiency and flexibility. For enterprises, this means faster performance, more secure and cost-efficient experiences, building a scalable path to deliver AI-powered value right at the endpoint.”

Jaguar Shores Design Coming Soon…ish

Meanwhile, product development continues apace, as the Jaguar Shores chip—Intel’s name for the AI accelerator class—is expected to wrap up the design phase by mid-2026. And Intel is already working with ASIC design operation AI chip to get the job done. This will be a big step forward for Intel, giving it a major entry into the datacenter AI hardware market. Previously, it had been struggling to get a foothold therein.

Given that this market is already largely tied up by several competitors, Intel will have its work cut out for it trying to break inertia and draw customers from brands said customers have already been working with. Intel will need to not only deliver a solid chip to draw interest, and at a good price, but will also need to prove Jaguar Shores is not a flash-in-the-pan, one-time operation.

Is Intel a Buy, Hold or Sell?

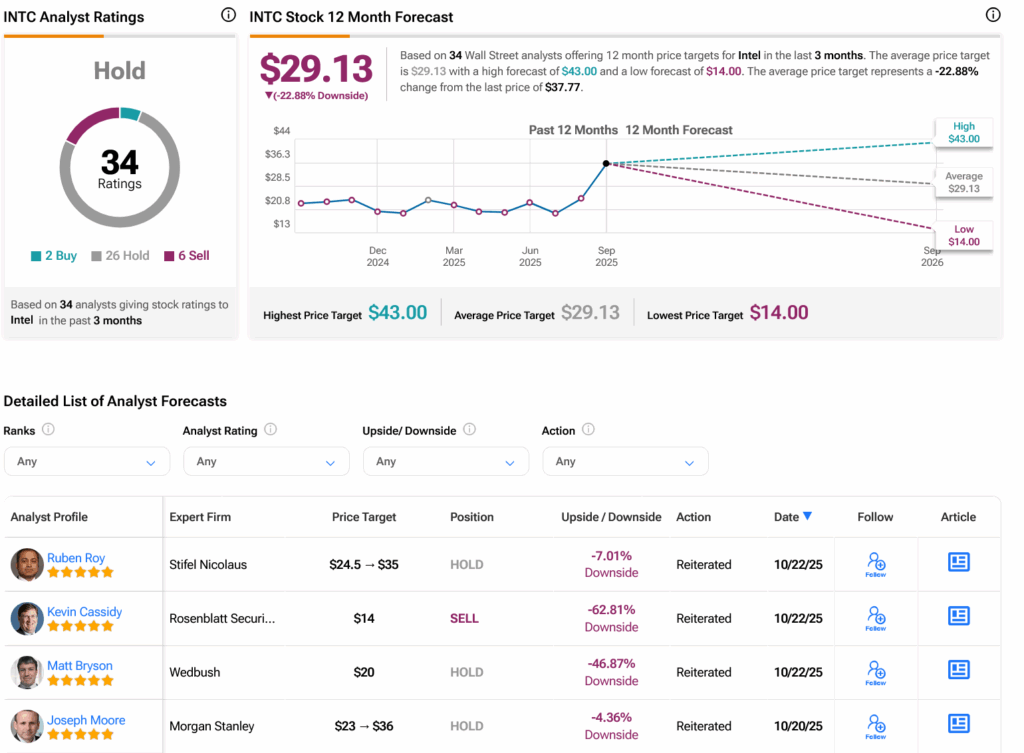

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 26 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 65.26% rally in its share price over the past year, the average INTC price target of $29.13 per share implies 22.88% downside risk.