Business process automation company Exela Technologies, Inc. (NASDAQ: XELA) has reported weaker-than-expected results for the fourth quarter ended December 31, 2021. A decline in revenues was the primary contributor to the muted results.

Following the disappointing results, shares of the company declined 32.7% to close at $0.57 on Friday.

Revenue & Earnings

Exela Technologies reported quarterly revenues of $294.3 million, down 6.3% from the previous year. Further, the figure failed to surpass the consensus estimate of $296.2 million. An 11% decline witnessed in the revenues of the ITPS segment impacted the overall revenues of the company.

The company’s loss per share for the quarter stood at $0.34, wider than the consensus estimate of a loss of $0.09 per share.

Meanwhile, the company’s adjusted EBITDA margin for the quarter improved from 11.8% in the previous year to 13.4%.

However, net cash used in operating activities stood at $111.5 million, compared to $29.8 million in the previous year.

Management Commentary

The CEO of Exela Technologies, Ronald Cogburn, said, “We are pleased with our execution and meeting our latest revenue expectations for the full year 2021 while also producing higher gross profit dollars despite lower year-over-year revenue. As COVID-19 headwinds subside, we are pleased with higher renewal rates, expansion with existing customers, new wins and a healthy pipeline.”

Stock Rating

The stock has a Moderate Buy consensus rating based on 1 Buy. Two months ago, Cantor Fitzgerald analyst Josh Siegler reiterated a Buy rating on the stock with a price target of $5 (772.6% upside potential). Shares of the company have declined 84.8% over the past year.

Negative Sentiment

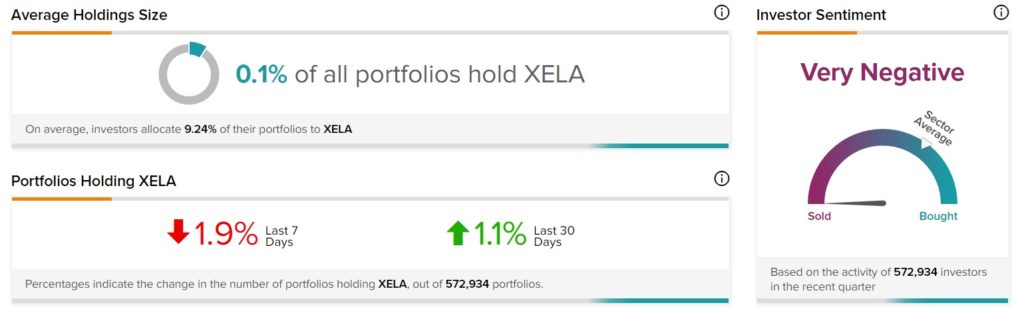

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on XELA, as 1.1% of portfolios tracked by TipRanks increased their exposure to XELA stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Colgate-Palmolive Announces Dividend Hike, $5B Share Repurchase Plan

AudioEye Delivers Stellar Q4 Results; Acquires Bureau of Internet Accessibility

Peloton Working on New Subscription Plan for Bike and Content