Cathie Wood’s ARK Invest ETFs (exchange-traded funds) revealed several key portfolio moves for Monday, October 20, 2025, showing renewed focus on diagnostics and health-tech innovation. The largest buy came from the ARK Genomic Revolution ETF (ARKG), which purchased 90,731 shares of Exact Sciences (EXAS) worth about $5.56 million. Exact Sciences, known for its non-invasive cancer screening tests, continues to be a key holding in ARK’s genomics strategy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

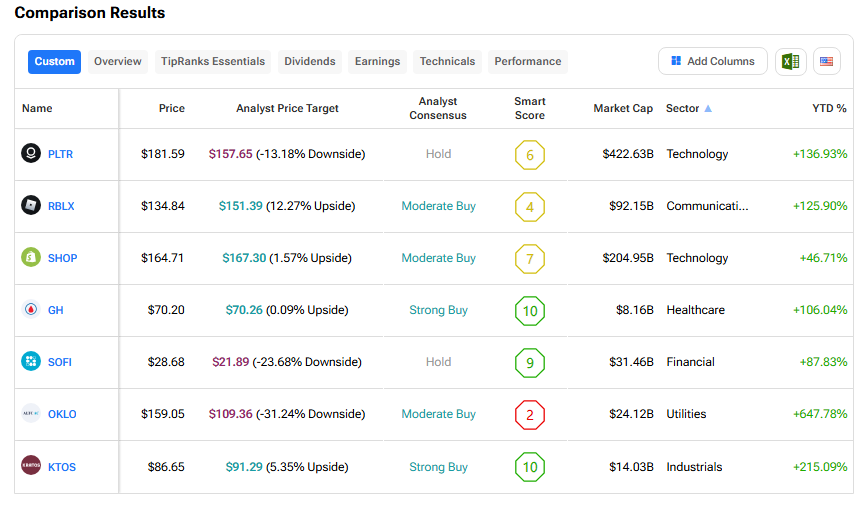

ARKG also added to its position in Illumina (ILMN), a gene-sequencing company, investing about $2.77 million. It also picked up shares of Qualcomm (QCOM), a chipmaker, worth $3.33 million, and BYD Co. (BYDDY), an electric vehicle maker, for around $941,000, showing confidence in select tech and EV stocks.

More Key Buys Across Tech and Defense

In the ARK Autonomous Technology and Robotics ETF (ARKQ), Wood boosted exposure to Intuitive Surgical (ISRG), a leader in robotic surgery, buying 9,174 shares worth about $4.09 million. The ETF also bought 11,714 shares of L3Harris Technologies (LHX), a defense and aerospace company, for $3.33 million, adding to its existing stake.

Smaller but strategic buys included Synopsys (SNPS) for $1.65 million, Teledyne Technologies (TDY) for $2.51 million, and Klarna Group (KLAR) for $2.49 million, showing ARK’s continued interest in innovative software and payments companies.

Here’s how ARK’s latest buys stack up, based on TipRanks’ Stock Comparison Tool:

Wood Trims Stakes in Guardant, Kratos, and Tech Names

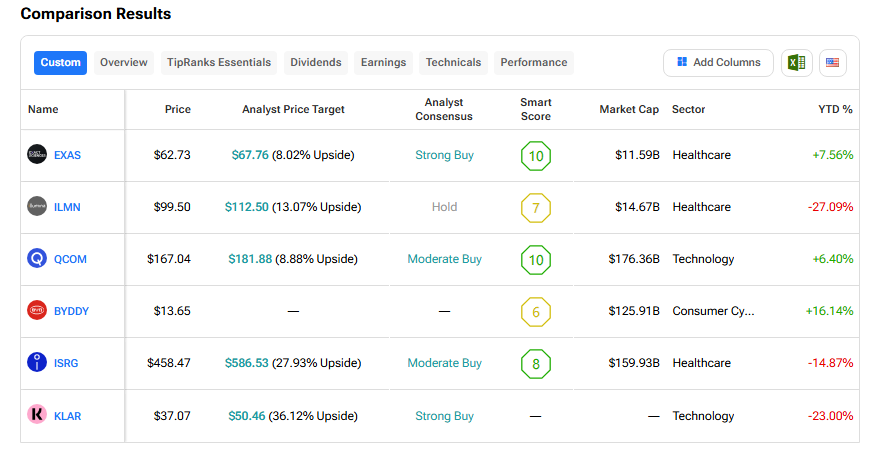

On the sell side, ARK’s biggest move was a sharp reduction in Guardant Health (GH), a cancer diagnostics company, offloading 124,233 shares worth about $8.13 million through the ARKG ETF. The sale continues ARK’s recent trend of cutting exposure to precision oncology names.

In the defense sector, ARKQ sold 96,699 shares of Kratos Defense & Security Solutions (KTOS) valued at $8.04 million, extending its pullback from defense holdings.

Other notable reductions included Oklo (OKLO), a nuclear energy firm, for $8.72 million; Palantir Technologies (PLTR), a data analytics company, for $3.6 million; Shopify (SHOP), an e-commerce platform, for $3.53 million; SoFi Technologies (SOFI), a fintech firm, for $3.70 million; and Roblox (RBLX), an online gaming platform, for $3.64 million.

Here’s how ARK’s latest sales compare, according to TipRanks’ Stock Comparison Tool: