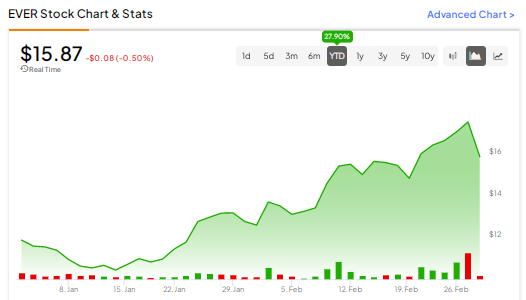

2023 marked a pivotal point for EverQuote (NASDAQ:EVER), a Cambridge, Massachusetts-based online insurance marketplace, connecting insurance-seekers with suitable providers. The company unveiled impressive Q4 financial results, surpassing estimates. With the stock up nearly 28% year-to-date, investor and Wall Street sentiment is bullish on EverQuote. The analysts’ average price target indicates that the stock has more room to run.

Unique Business Model

EverQuote’s unique business model does not rely on direct insurance quoting, but instead uses historical data to recommend insurance companies to customers, generating revenue through referral fees.

Initially focused on car insurance, EverQuote broadened its offerings to include home and life insurance. The company exited the health insurance vertical at the end of Q2 2023, saying that this area requires massive capital investment and scale to effectively compete. The move was a part of the company’s efforts to streamline its operations and focus on core verticals.

The auto insurance industry has been volatile in recent years, as many carriers have struggled to achieve sufficient underwriting profitability. This has hurt EverQuote. However, many insurers are approaching the market in 2024 with a growth mindset, which bodes well for the company.

On the Right Track

EverQuote reported robust Q4 2023 financial results, beating estimates with an EPS of $-0.19 versus the expected $-0.31. The company’s Q4 revenue of $55.7 million also surpassed the consensus estimate of $49.8 million. The company witnessed a strong growth in enterprise carrier spend in Q4 2023 compared to the third quarter.

EverQuote’s recent strategic restructuring, including a 40% reduction in headcount and a focused return to its core P&C (property and casualty) insurance marketplace, resulted in operational improvements and stronger capital efficiency.

Management believes that with a focus on continued execution and strength in EVER’s balance sheet, the company looks forward to benefiting from auto carrier recovery and expects revenue acceleration through 2024.

What is the Outlook for EVER in 2024?

Analysts have been bullish on EVER stock for some time. JPMorgan named it one of the “Internet Stocks to Own in 2024” and stated it is well positioned to benefit from the auto carrier recovery, with revenue accelerating through 2024.

Following the Q4 results, JPMorgan analyst Cory Carpenter raised the price target for EverQuote stock to $25 from $13 and reiterated a Buy rating. The analyst believes that Progressive, the company’s largest customer, is fueling the bulk of higher spend so far. That said, Carpenter noted that other carriers are also starting to ramp up their spend.

Similarly, Needham analyst Mayank Tandon reiterated a Buy rating and raised the price target for the stock to $25 from $15. He believes that ”EVER’s growth is set to inflect higher over FY24 and there could be upside to Street estimates as the recovery in carrier marketing spend takes shape.”

EVER is rated a Strong Buy, with a Buy recommendation from six of the seven analysts who rated the stock in the past three months. The lone dissenter, Oppenheimer’s Jed Kelly, has maintained a Hold rating on the stock. At $24.33, the average price target implies more than 55% upside potential from current levels.

Final Thoughts

EverQuote has successfully emerged from a year of strategic restructuring, realigning its business and positioning itself for robust growth in 2024. Strong Q4 results and the predicted recovery of the auto carrier sector bode well for the company’s growth trajectory.

Wall Street analysts are bullish on these positive developments and project that EVER stock could drive significant returns for shareholders moving forward.