Shares of Etsy (NASDAQ: ETSY) were down in pre-market trading on Thursday after Jeffries analyst John Colantuoni went from being bullish on the e-commerce company to turning bearish and downgrading the stock to a Sell from a Buy. The analyst has a price target of $85 on the stock implying a downside potential of 24.9% at current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Colantuoni called out the higher valuation premium for ETSY versus its peers. The stock is currently trading at a price-to-earnings multiple of 28.4x versus a sector median of 14.5x. The analyst also believes that there is likely to be a downward revision to consensus earnings estimates as the company’s Gross Merchandise Sales (GMS) sales slow down. In Q4, Etsy’s GMS sales declined by 4% year-over-year to $4 billion.

The analyst has warned that Etsy’s higher marketing spend to contain churn is pressuring its EBITDA. Colantuoni commented, “With more limited take rate upside and deteriorating buyer trends, we see downside to consensus from slowing top line and moderating margin expansion.”

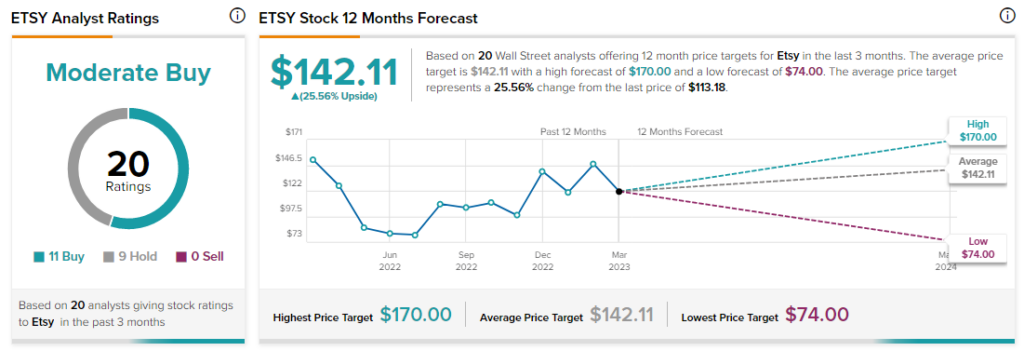

However, besides Colantuoni, other analysts are cautiously optimistic about ETSY stock with a Moderate Buy consensus rating based on 11 Buys and nine Holds.