Valentine’s Day is here, and if you plan to gift something unique, consider high-yield dividend-paying stocks that could generate steady passive income for your loved ones. Leveraging TipRanks’ Best High Yield Dividend Stocks tool, we zero in on Energy Transfer (NYSE:ET) and Enterprise Products Partners (NYSE:EPD).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Both ET and EPD stocks are loved by analysts. These stocks sport a Strong Buy consensus rating and offer stellar yields of more than 7% near the current price levels.

Let’s delve deeper.

Is ET Stock a Good Buy?

This energy infrastructure company that transports crude oil, natural gas liquids, and other refined hydrocarbons increased its quarterly cash dividend by 3.3% to 0.3150 per share, or $1.26 on an annualized basis, in January. This translates into a compelling forward yield of 8.9%.

Notably, the company will release its fourth-quarter financials after the market closes on Wednesday, February 14, 2024. Analysts expect Energy Transfer to post revenue of $21.46 billion, up 4.7% year-over-year. Meanwhile, analysts expect the company’s earnings to stay flat at $0.34 per share in Q4.

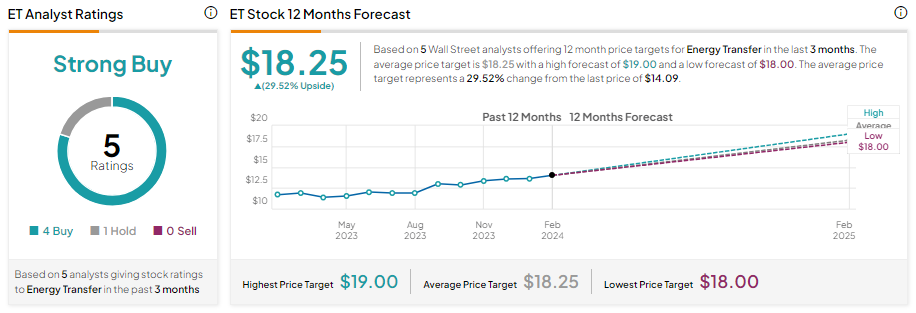

Wall Street is bullish about ET’s prospects ahead of Q4 earnings. The stock has gained about 19.6% in one year and has four Buy and one Hold recommendations for a Strong Buy consensus rating. Analysts’ average price target of $18.25 implies an upside potential of 29.52% from current levels.

What is the Average Dividend Increase for EPD?

Enterprise Products Partners transports natural gas, crude oil, refined products, and petrochemicals. EPD is a Dividend Aristocrat (learn more about Dividend Aristocrats here) and has increased its dividend for 25 consecutive years at an average annualized growth rate of 7%. Further, it offers an attractive yield of 7.6%.

The company’s diversified revenue base, growing adjusted EBITDA, solid pipeline of growth projects, and focus on maintaining low leverage for financial flexibility augur well for future growth.

Wall Street analysts are bullish about EPD’s prospects. EPD stock has a Strong Buy consensus rating based on seven Buy and two Hold recommendations. These analysts’ average price target of $32.11 implies 21.12% upside potential.

Bottom Line

These dividend stocks sport a solid track record of dividend payments and growth. These dividend-paying companies offer high yields, and they carry a Strong Buy consensus rating, which makes them attractive investments.