The bidding war to acquire United States Steel (NYSE:X) just grew more interesting, with Esmark withdrawing its bid to acquire the steel maker. Esmark announced on August 23 that it is bowing to the United Steelworkers union’s pressure and will no longer be a party to U.S. Steel’s acquisition bid. X stock dropped 2.2% on the news yesterday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

U.S. Steel’s Takeover Drama Continues

Three known names in the war to buy U.S. Steel included America’s largest steel manufacturer, Cleveland Cliffs (NYSE:CLF), industrial conglomerate Esmark, and ArcelorMittal (NYSE:MT). However, the United Steelworkers union gave their full support to Cleveland Cliffs’ offer, stating that they had a right to do so under their labor agreement with X. Following this, U.S. Steel clarified that the union does not have the power to block the deal.

Even so, Esmark has decided to respect the union’s decision and is withdrawing the bid. “Esmark maintains a solid working and personal relationship with the USW organization and its leadership,” the company added.

Earlier, Esmark had offered to buy X in an all-cash deal for over $7 billion. Chief James Bouchard had also noted that Esmark had $10 billion in cash on its balance sheet, ready to finance the acquisition. Meanwhile, CLF has also offered to buy X for nearly the same amount, but in a cash-and-stock deal. At the same time, the exact details of ArcelorMittal’s bid remain unknown. So far, CLF seems to be the only realistic buyer for U.S. Steel.

Is U.S. Steel a Good Buy, as per Analysts?

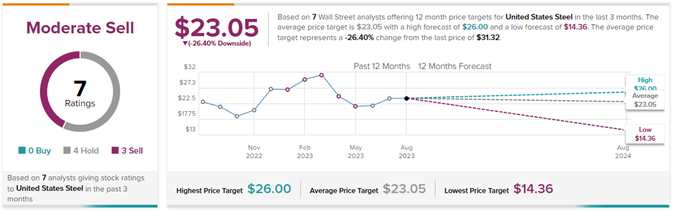

Looking at all the ongoing drama, it indeed seems that the takeover of America’s second-largest steel maker won’t be a cakewalk. Analysts remain skeptical about U.S. Steel’s trajectory. It’s interesting to see how Wall Street is assigning a lower price target to X stock despite takeover bids hovering around $35 per share. Also, not a single analyst has assigned a Buy rating to X stock in the past three months. Meanwhile, X stock has gained 47.9% in the past three months, thanks to the bidding war.

Recently, BMO Capital analyst Katja Jancic reiterated a Hold rating on X stock with a price target of $26 (17% downside).

Similarly, Wolfe Research analyst Timna Tanners reiterated her Sell rating on U.S. Steel with a price target of $20 (36.1% downside potential).

Overall, X stock has a Moderate Sell consensus rating based on four Buys and three Sell ratings. On TipRanks, the average United States Steel price target of $23.05 implies 26.4% downside potential from current levels.