Equinox Gold (NYSE American:EQX), a growth-oriented gold mining company, has benefited from the recent surge in gold prices. With one of Canada’s largest gold mines set to begin producing in 2024, the company is looking to improve upon last year’s robust financial results. EQX is trading at rich valuations, indicating that the stock already reflects much of the anticipated growth potential.

Growth-Oriented Gold Mining

Equinox Gold is a growth-oriented mining company primarily focusing on the exploration, acquisition, development, and operation of gold mining assets. Boasting seven producing mines in Brazil, Mexico, and the United States, the company has several growing projects, including the Greenstone gold mine in Ontario.

Greenstone is one of the largest and highest-grade open-pit gold mines in Canada. As it comes online in 2024, the company anticipates that ramping up production will significantly lower operating costs and boost cash flow. In 2023, the company hit its production target with just over 564,000 ounces and expects an increase in production to between 660,000 and 750,000 ounces this year, driven by Greenstone operations.

Further, gold prices have recently risen beyond $2,100/oz, marking a new all-time high, primarily propelled by anticipations of a June interest rate cut by the U.S. Federal Reserve. This upward movement in the price of gold significantly benefits Equinox Gold by improving the company’s margins above its all-in-sustaining costs (AISC) of $1,630 to $1,740 per ounce.

Equinox Gold’s Recent Results

Equinox had a record-breaking quarter for Q4 2023, with the highest gold production and sales realized to date. The company sold 150,000 ounces of gold at an average rate of $1,983 per ounce, generating revenue of $298 million. While this marked an increase of 14.8% year on year, it fell short of expectations by $5.7 million.

Income from mine operations increased considerably, reaching $39 million, a $13 million increase over Q3’s income and a $6.6 million increase year-over-year. This helped the company beat expectations for earnings per share, delivering $0.01 vs. expectations of -$0.01. The primary driver for this increase is the higher gold prices realized in Q4.

Meanwhile, rising costs observed year-over-year were primarily due to the impact of inflation and unfavorable fluctuations in the Brazilian Real and Mexican Peso, which affected several of the company’s operations.

Where EQX Stock Stands Now

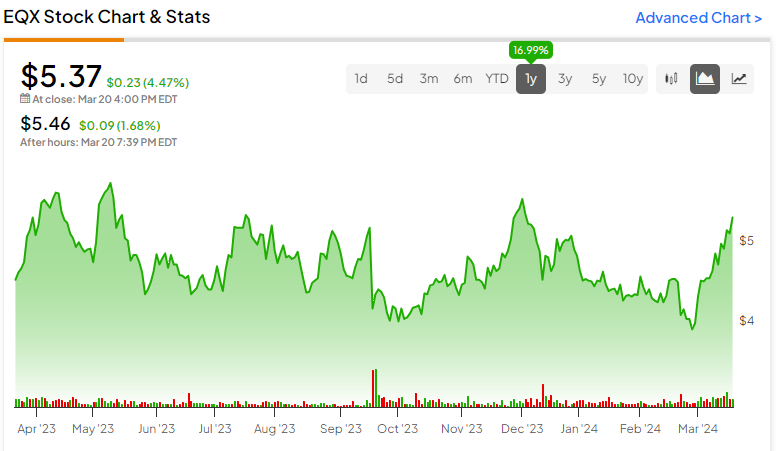

EQX stock has been trending up over the past year, advancing nearly 17%. Shares are trading toward the higher end of the 52-week range of $3.95-$5.84. Ongoing positive price momentum has the shares trading above the 20-day moving average (4.71) and above the 50-day moving average (4.61).

Based on comparative metrics, the stock appears richly valued. The P/E ratio (59.67x) sits well above the averages for the Basic Materials sector (22.45x) and the Gold industry (21.84x). It’s likely the market is pricing in healthy expectations for growth related to developments at Greenstone, warranting the higher multiple.

Is EQX Stock a buy?

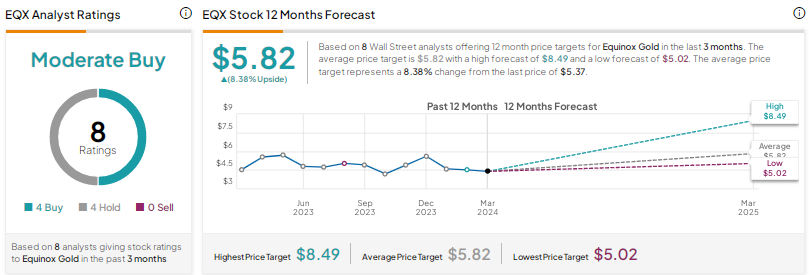

EQX is rated a Moderate Buy based on four Buy and four Hold ratings over the past three months. The average price target for EQX is $5.82 which represents an 8.38% upside from current price levels.

Analysts have taken a cautious stance regarding the stock recently, with many shifting price targets lower. For instance, BMO Capital analyst Kevin O’Halloran lowered the price target on EQX stock to $7.50 while maintaining a Buy rating. He maintains that the company should re-rate to higher multiples as Greenstone advances.

Final Analysis on EQX

Equinox Gold has a promising outlook, with its major project, the Greenstone gold mine, expected to significantly contribute to profitability. Despite the impact of inflation and currency fluctuations, a record-breaking Q4 underscores the company’s operational strength and potential for growth (provided gold prices continue to offer margin support).

While the stock market valuation may appear high, it reflects the promising expectation of the Greenstone project. Investors considering Equinox Gold will want to closely monitor potential opportunities linked to the company’s significant expansion trajectory and the broader market trends influencing the gold mining industry, including the speculative movement in the price of gold itself.