Enphase (NASDAQ:ENPH) investors didn’t have a good day after shares of the solar energy company tanked by more than 7% in today’s trading. This decline can be traced back to two reasons: an analyst downgrade and a departing executive.

Citi analyst Vikram Bagri downgraded Enphase from Buy to Hold and lowered the price target from $126 to $121 per share. Bagri is mostly concerned about the short-term outlook, labeling it as “uncertain,” especially for residential solar. He also anticipates a slower-than-anticipated recovery in the U.S. market and believes the firm is fully valued at this point.

At the same time, Enphase announced that it would see David Ranhoff, the Executive VP and Chief Commercial Officer, leave the company. Although Ranhoff said that his departure was due to personal reasons, it didn’t help investor confidence in the face of Citi’s downgrade.

Is Enphase Still a Buy?

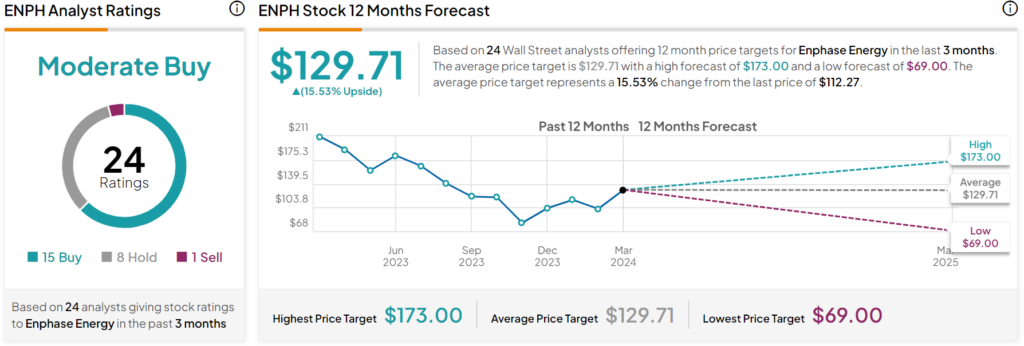

Overall, Wall Street analysts have a Moderate Buy consensus rating on ENPH stock based on 15 Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 41% decline in its share price over the past year, the average ENPH price target of $129.71 per share implies 15.53% upside potential.