One might think that being a solar stock right now in an age of energy uncertainty would be a great move. However, for Enphase Energy (NASDAQ:ENPH), it’s not proving so great a move. Enphase lost almost 5% at one point in Thursday afternoon’s trading, and it’s mostly because of an analyst cut from Buy to Hold.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The word came from Wolfe Research analyst Steve Fleishman, who noted that there were already headwinds in the market as far as home power generation was concerned. Throw in the arrival of NEM 3.0 in California, and that only made matters worse. NEM 3.0 basically hampers the economic value of home power generation without the addition of a battery, which is particularly expensive. Throw in rising interest rates, which makes it tough for homeowners to take out loans to add on Enphase products, and that puts several hurts on Enphase’s business all at once.

While there’s likely to be some gain from international growth—international sales already doubled in both 2021 and 2022, and 2023 is looking on track to put at least close to yet another double on—these amounts weren’t all that great to start with. Meanwhile, reports suggest that Enphase might be working to improve its standing in California by offering better battery solutions, which would take the teeth out of NEM 3.0.

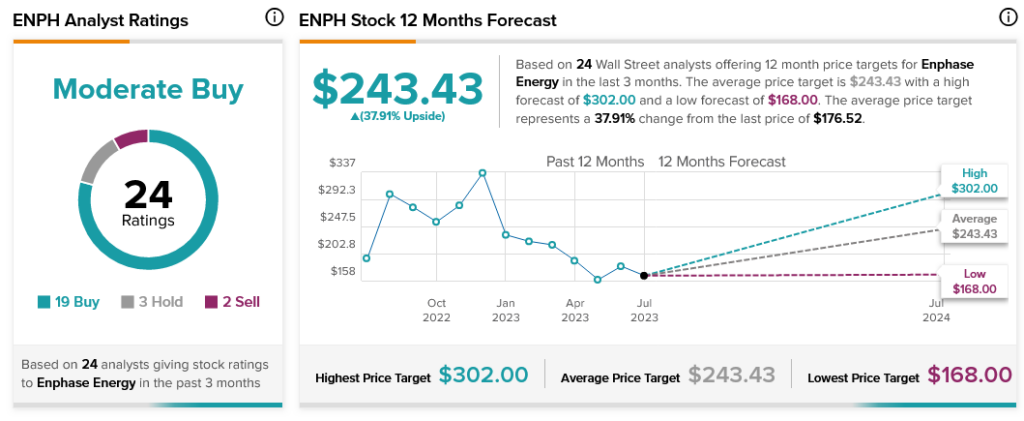

Analysts are feeling that potential all around. With 19 Buy ratings, three Hold and two Sell, Enphase Energy stock is considered a Moderate Buy by analyst consensus. Throw in an average price target of $243.43 and Enphase Energy stock also offers investors a pretty attractive 37.91% upside potential.