Enphase Energy (NASDAQ:ENPH) managed to pull off a bit of a coup today, as it not only took a rating cut from an analyst but also managed to gain ground in spite of that cut. Enphase was up over 3% in the closing minutes of Monday’s trading session, and even as one analyst cut, other analysts think that investors made the right call by pouring in.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The cut came from BMO Capital via analyst Ameet Thakkar. Thakkar dropped Enphase’s rating from Outperform to Market Perform and also cut the price target from $175 to $148. Essentially, Thakkar noted, residential solar demand in the U.S. is in the doldrums, and just when it climbs back out is, at best, unclear. While Thakkar’s own expectations, which are to see Enphase climb out of its rut somewhere around the second quarter of 2024, remained in place, he also looks for revenues to gain just 2% year-over-year. A return to the impressive levels seen in 2022, meanwhile, will only happen somewhere around 2025 or even 2026.

Perhaps a pessimistic outlook, and one not shared universally. In fact, Giesbers Investment Strategy offered up its own analysis, noting that the recent pullback in share prices may provide a nice entry point for investors. Throw in a solid growth pattern—even Thakkar doesn’t dispute that growth is on the menu—and the end result should be positive. And, just to top it off, Enphase is also likely to benefit from increasing interest in energy independence. Of course, it’s also going to have to tackle issues at the consumer level, but the thesis does have some validity to it.

Is Enphase Energy a Buy, Sell, or Hold?

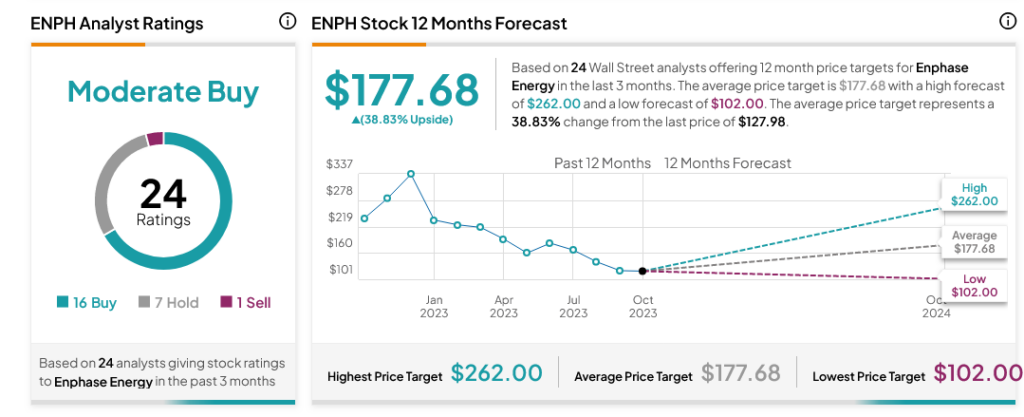

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ENPH stock based on 16 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average ENPH price target of $177.68 per share implies 38.83% upside potential.