Shares of solar stock Enphase (NASDAQ: ENPH) saw a small rise in value at the time of writing, even amidst an analyst downgrade by Truist Securities. Indeed, analyst Jordan Levy now deems ENPH stock a ‘Hold’ with a revised price target of $135. For reference, he previously had a ‘Buy’ rating with a significantly higher price target of $210. This can be attributed to expectations of a prolonged recovery in the U.S. residential solar markets, a reality not yet reflected in the current share prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, Levy believes the firm’s superior margin structure and standout products and technology justify the stock’s premium when compared to the industry average. In addition, Levy maintained his optimism for other players in the sector, holding onto ‘Buy’ recommendations for SolarEdge Technologies (NASDAQ:SEDG) and Shoals Technologies (NASDAQ:SHLS), albeit with slightly trimmed price targets, while boosting Array Technologies’ (NASDAQ:ARRY) prospects with an uplifted price target of $38.

Is ENPH a Good Buy Right Now?

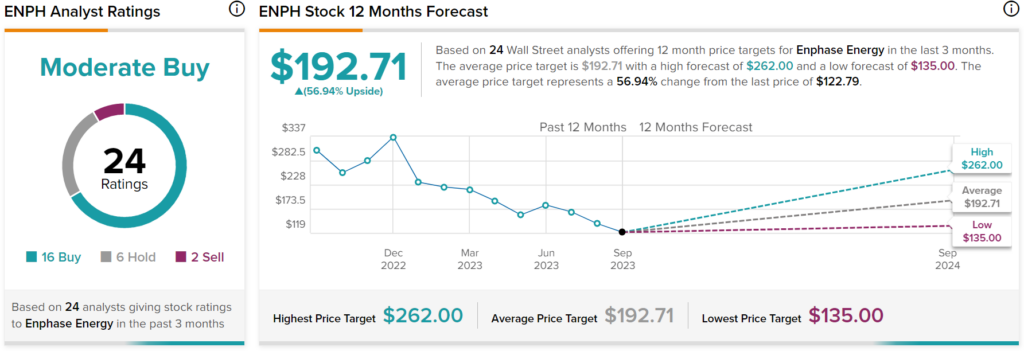

Overall, analysts have a Moderate Buy consensus rating on ENPH stock based on 16 Buys, six Holds, and two Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $192.71 per share implies 56.94% upside potential.