Tesla’s (TSLA) shares have surged higher, now trading around the mid-$420s, more than double the 52-week low of nearly $212. The ongoing surge has fed on AI/robotaxi hype, improving sentiment on margins, and a fresh vote of confidence, as Elon Musk just last week bought nearly $1 billion of stock in the open market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That’s his first big buy since 2020, and it signals he thinks the next act is worth owning. Still, one driver most folks underrate is Tesla’s Energy business. If you’re modeling the next five years, that division could be the quiet accelerant that keeps the rally from stalling, even after this big run.

Tesla’s core business — led by the Model Y and now reinforced by the Robotaxi launch — is being supplemented by a familiar revenue driver: its energy arm. Powerwall deployments reached a record in Q2, while Megapack capacity continued to expand despite tariffs and supply chain pressures, providing Tesla with added support in a more competitive market.

Perhaps most important is TSLA’s proven ability to bounce back from company-crushing news that would have dampened the performance of other names. TSLA stock fell from approximately $450 to $240 in the first half of 2025 due to a political scandal, but has since regained its composure and trades confidently above $400 per share. Taken together, I’m reassuringly Bullish on TSLA stock.

Why Energy Gets Forgotten

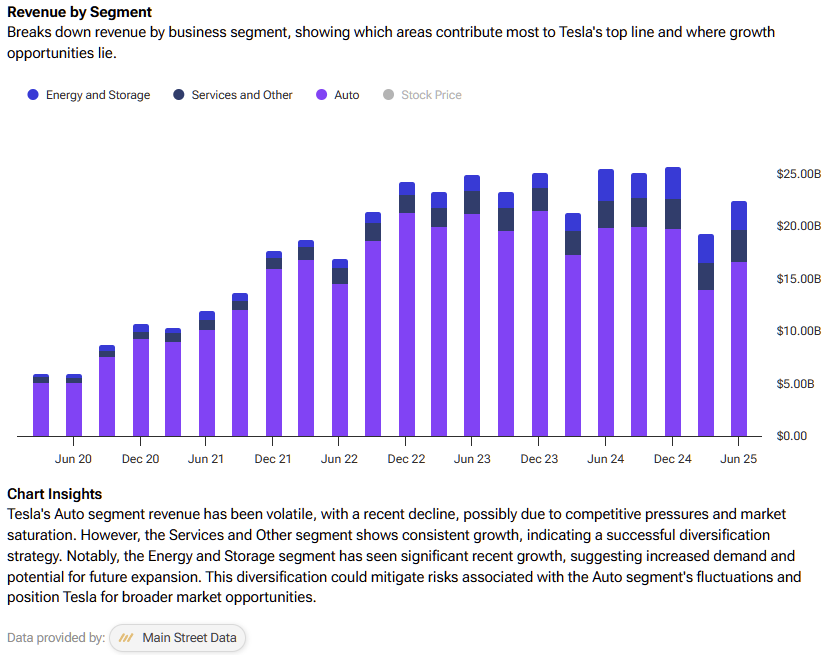

Energy results have often appeared “lumpy” in quarterly reports, leading some investors to shrug. That’s understandable, since timing plays a major role. Megapack deployments tend to come in large batches, making revenue and profits swing from quarter to quarter. Management has noted that trailing-twelve-month deployments continue to set records, but even one slow commissioning cycle can make a quarter look soft and reinforce the “meh” attitude.

There have been real stumbles, too. The legacy solar side has been an underperformer, as installations fell sharply through 2023 and Tesla later stopped breaking out the quarterly solar MW figures, which is a sign that business wasn’t trending well. California’s NEM 3.0 policy change also kneecapped rooftop solar demand across the state, crimping orders for installers industry-wide, all while there is tariff uncertainty and supply-chain noise. So you can see why many investors discount Energy as a durable growth engine.

The Sleeper Business Starts to Roar

However, despite these apparent headwinds, the picture is different under the hood. Tesla deployed 9.6 GWh of energy storage last quarter and reported a record $846 million in Energy gross profit. Management also noted that TTM storage deployments hit their 12th consecutive quarterly record, indicating that scale is becoming increasingly prominent.

Capacity is opening up fast. The Megafactory in Lathrop keeps spitting out Megapacks, and Shanghai’s new Megafactory is ramping toward 10,000 units a year (≈40 GWh), with, notably, the first Megapacks from Shanghai already shipping. Tesla also says it’s on track to make domestic LFP cells for storage in the U.S. this year, which should tighten costs and de-risk supply, which really matters when you think about it because the Energy unit is running at roughly ~30% gross margin, comfortably above automotive, which means each incremental GWh is potent for earnings.

And the tailwinds aren’t just “Tesla hype.” Texas and California are leading a battery buildout to stabilize grids and meet the power demands of the AI era. Utilities require fast-to-deploy firming capacity, and Megapack fits that job description. Management also states that paired solar-plus-storage can be installed four times faster than comparable fossil fuel assets. Skeptics can’t convince me that Energy is not an exciting segment.

Why Tesla Won’t Trade Like Detroit

On valuation, let’s first ground this in the consensus EPS path, which looks like this: $1.70 (2025), $2.43 (2026), $3.24 (2027), $5.90 (2028), $9.46 (2029), $13.94 (2030). At first glance, today’s price implies eye-watering forward multiples. Still, a steep compression over time, from roughly 246x 2025 EPS to 30x 2030, suggests that these multiples may be justified if Tesla executes or outperforms these estimates.

And that last part is overlooked, because Energy could be the key to supercharging that journey. As Megapack scales upwards and outwards, fixed costs spread wider and margins expand, nudging EPS higher even if auto volumes wobble. Last quarter already showed Energy acting as a shock absorber.

So, yes, Tesla trades far above carmakers like Toyota (TM), General Motors (GM), and Ford (F), which have single-digit to low-teens P/Es. But the market hasn’t valued Tesla purely as an automaker in years, because it’s an energy-and-software platform with optionality in autonomy and robotics layered on top. As energy production grows at scale, the multiple is likely to remain elevated, rather than cheap, because the earnings base itself is evolving. Bargain hunters may wait forever for a Detroit-style entry point.

Is TSLA Stock a Buy, Hold, or Sell?

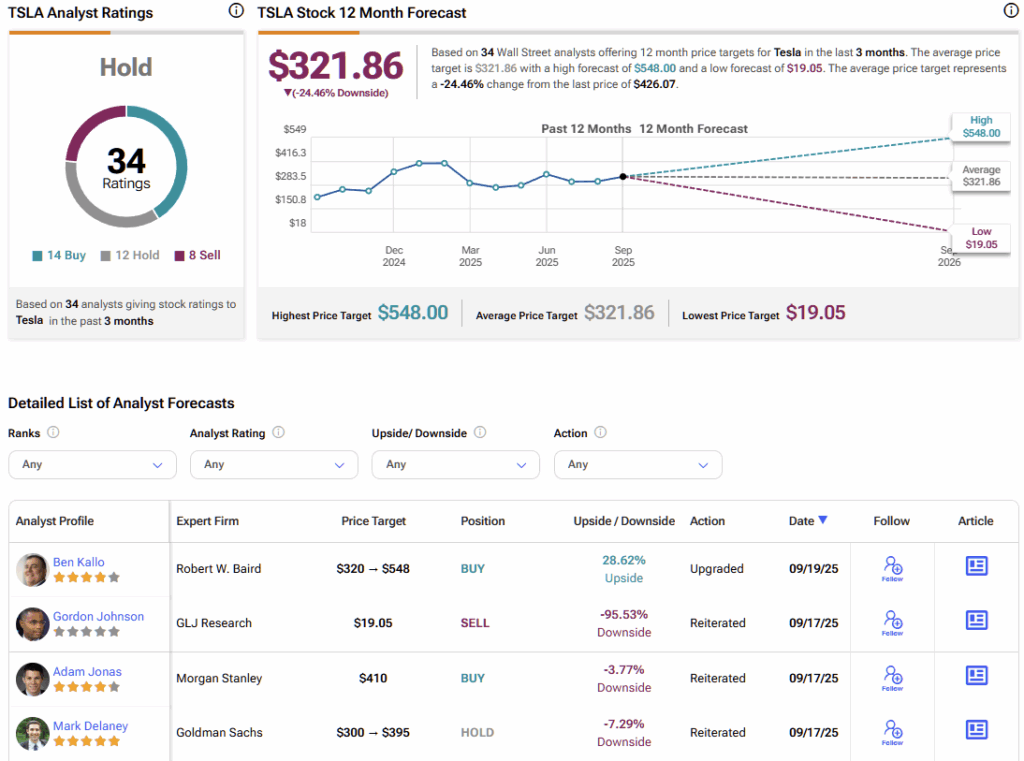

Currently, analyst sentiment is quite mixed on Tesla. The stock carries a Hold consensus rating, based on 14 Buy, 12 Hold, and eight Sell ratings assigned over the past three months. Moreover, TSLA’s average stock price target of $321.86 implies 24.5% downside over the next twelve months, meaning Wall Street believes TSLA stock is relatively overvalued following its recent rally.

Tesla’s Next Rally May Be Powered by Energy, Not Cars

After a monster rebound, Tesla’s bull case can’t ride only on robotaxi headlines. The Energy business is proving it can grow quickly, generate attractive margins, and benefit from secular grid needs that are not tied to monthly delivery tallies. When you combine these factors with a record $846 million Energy gross profit last quarter, rising global Megapack capacity, and domestic LFP cell plans, you’ve got a long-term catalyst hiding in plain sight.

That’s why, even after the rally and despite the premium multiple, I remain Bullish, because the next leg may come from the part of Tesla that most people still treat as a footnote.