Elon Musk and X Corp (PC:XAIIQ) have reached a settlement with four former top Twitter executives who claimed that they were denied $128 million in severance pay after being fired following Musk’s acquisition of the company. However, the exact terms of the agreement were not made public. The lawsuit, which was filed by former CEO Parag Agrawal, CFO Ned Segal, legal chief Vijaya Gadde, and general counsel Sean Edgett, alleged that they were forced out after Musk took control.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

More specifically, the former executives said that Musk wrongly accused them of misconduct to justify denying their severance, which they claim included one year’s salary and significant stock options. According to their complaint, these benefits had been promised long before Musk took over. Unsurprisingly, Musk and X have denied any wrongdoing and argued that the executives were dismissed for poor performance.

Nevertheless, this lawsuit is just one of several legal disputes that Musk has faced since acquiring Twitter for $44 billion in 2022. In fact, shortly after the takeover, he laid off more than half the workforce and rebranded the platform as X. This led to a separate lawsuit from laid-off Twitter employees who claimed that they were owed $500 million in severance, which X agreed to settle in August.

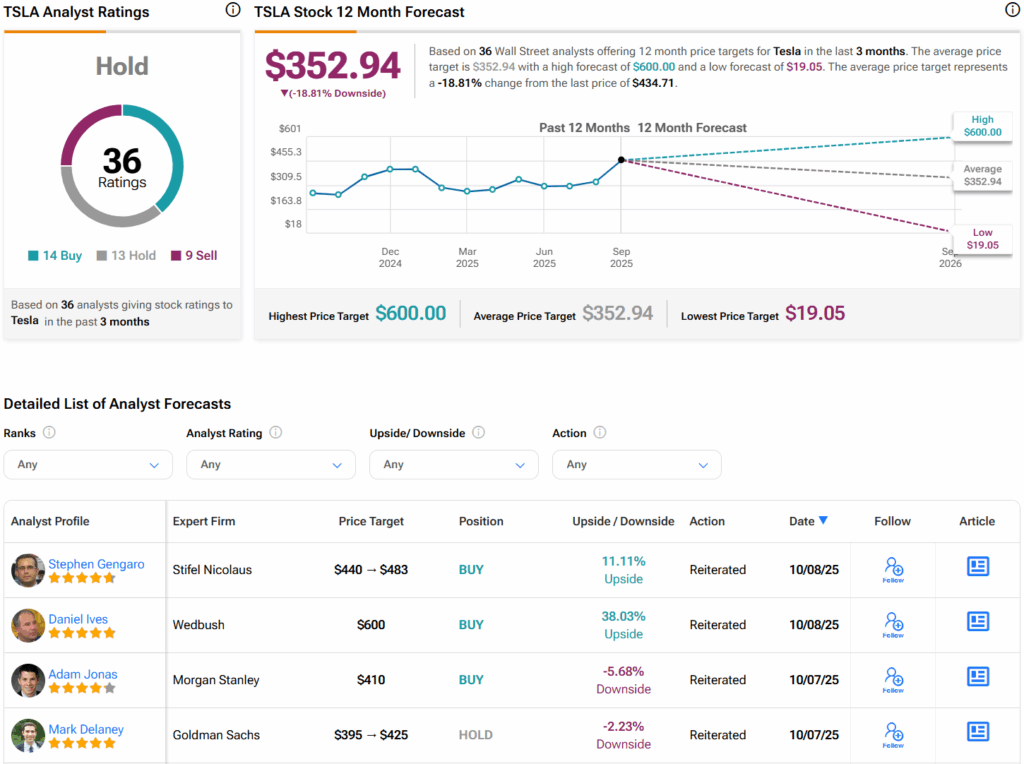

What Is the Prediction for Tesla Stock?

When it comes to Elon Musk’s companies, most of them are privately held. However, retail investors can invest in his most popular company, Tesla (TSLA). Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 13 Holds, and nine Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $352.94 per share implies 18.6% downside risk.