Elon Musk’s AI startup, xAI, has filed a lawsuit against OpenAI in California federal court, accusing the company of stealing its trade secrets. According to the filing, xAI claims that OpenAI is unfairly trying to gain an advantage in the race to build the best artificial intelligence tools by poaching former xAI employees. Unsurprisingly, the lawsuit centers on xAI’s AI chatbot, Grok, which the company believes was targeted through aggressive and unlawful recruiting tactics by OpenAI.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, these employees allegedly had direct knowledge of xAI’s confidential technologies, including how Grok was built and how xAI plans to operate and scale its data centers. xAI believes that OpenAI’s intent was to obtain information that would normally take years to develop. By targeting these insiders, xAI says OpenAI is shortcutting the innovation process and gaining access to secrets that are central to xAI’s strategy and success.

The lawsuit also claims that OpenAI encouraged these employees to break their legal obligations, such as confidentiality agreements, in order to gain access to the protected material. If true, this could raise some serious questions about fair competition in the AI industry, where access to proprietary data and systems can mean the difference between leading the field and falling behind.

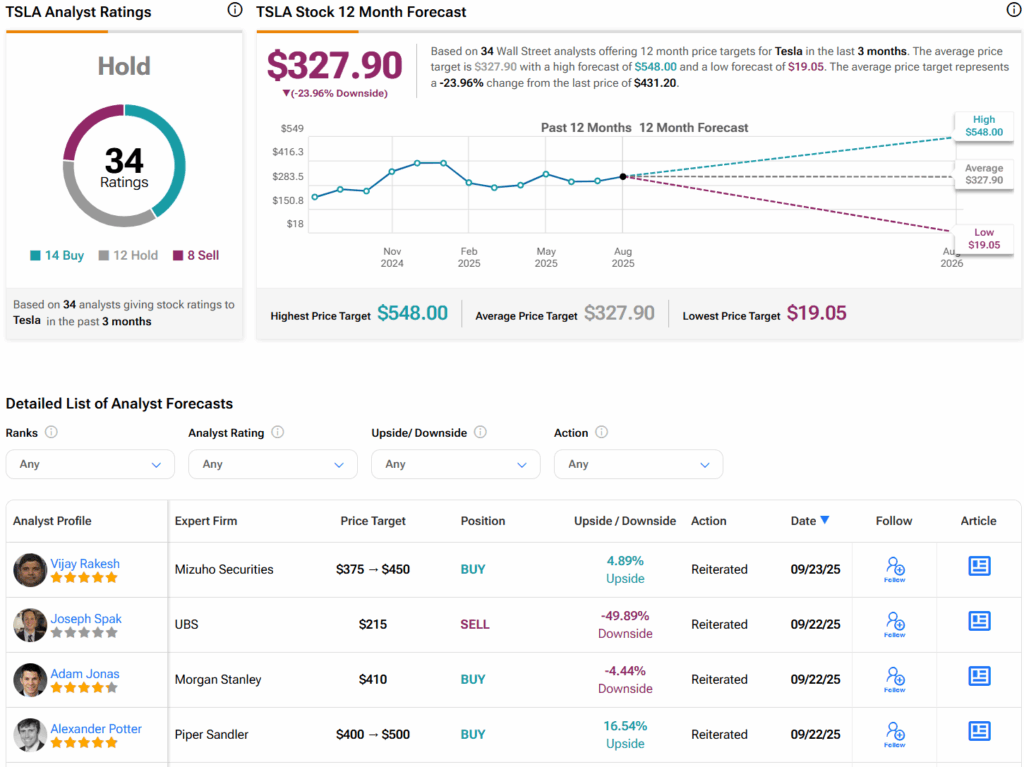

What Is the Prediction for Tesla Stock?

When it comes to Elon Musk’s companies, most of them are privately held. However, retail investors can invest in his most popular company, Tesla (TSLA). Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 12 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $327.90 per share implies 24% downside risk.