Tesla (TSLA) shares gained in early trading hours after shareholders approved Elon Musk’s record $1 trillion pay package, one of the largest in corporate history. The strong vote signals renewed support for Musk’s leadership and Tesla’s push into artificial intelligence (AI), robotics, and electric vehicles.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A Major Show of Support for Musk

More than 75% of shareholders backed the plan, which links Musk’s compensation to ambitious performance goals such as higher vehicle output, growth in Tesla’s AI and robotaxi units, and a move toward a multitrillion-dollar valuation.

By approving the deal, investors reaffirmed their trust in Musk’s leadership and ended doubts about his long-term commitment to the company. His focus now turns to major projects like Full Self-Driving (FSD), the Optimus robot, and the Cybercab platform.

Market Response to Musk’s Pay Approval

The shareholder approval drew a mostly positive response on Wall Street. Wedbush analyst Daniel Ives called the outcome a “huge win for shareholders.” He said it removes uncertainty around Musk’s role and refocuses attention on Tesla’s AI and robotics goals. Ives maintained a Buy rating on the stock with a $600 price target, saying the decision keeps Musk firmly at the helm during a crucial stage of growth.

Other analysts also see the vote as a show of confidence in Tesla’s future. Several market watchers noted that it could help restore momentum in the stock after weeks of volatility. However, not all investors were convinced. Norges Bank Investment Management, one of Tesla’s largest shareholders, voted against the plan, citing concerns over its size and governance issues.

The Road Ahead for Tesla Stock

The shareholder vote has lifted short-term sentiment and eased uncertainty around Musk’s leadership. But the focus now shifts to performance. Tesla’s next test will come from how quickly it can turn its AI, robotaxi, and robotics projects into meaningful growth.

Analysts say near-term momentum will depend on product updates, delivery trends, and progress in Full Self-Driving (FSD). If Tesla can show steady gains in these areas, the stock may hold its recent strength.

Is Tesla a Buy, Sell, or Hold?

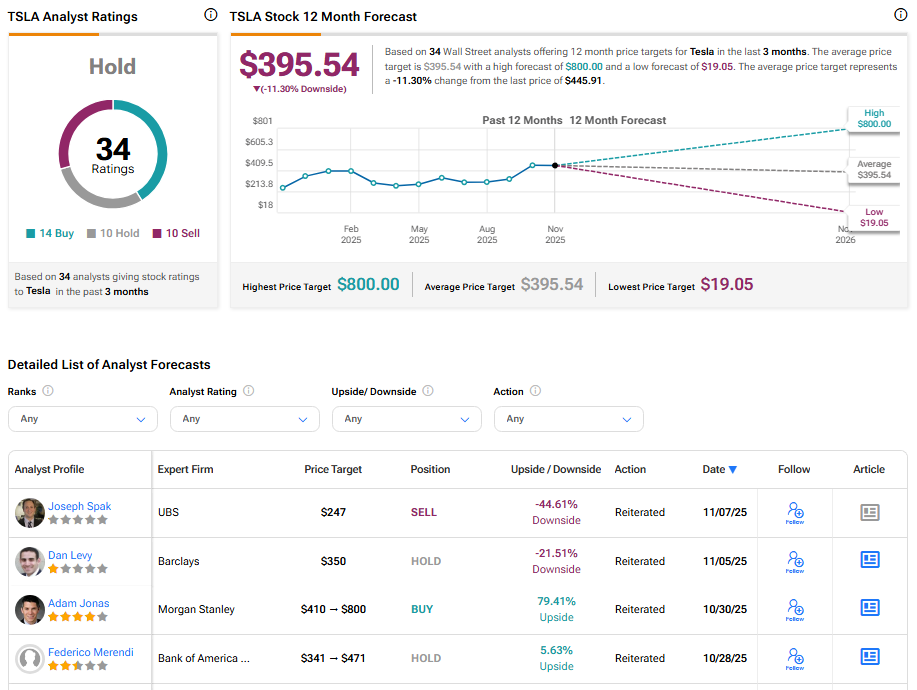

According to TipRanks, TSLA stock has received a Hold consensus rating, with 14 Buys, 10 Holds, and 10 Sells assigned in the last three months. The average Tesla stock price target is $395.54, suggesting a potential downside of 11.3% from the current level.