Wedbush’s top analyst Daniel Ives praised Tesla’s (TSLA) shareholder vote approving CEO Elon Musk’s nearly trillion-dollar pay package as a “huge win for shareholders.” Ives, a long-time Tesla bull, anticipated the package would pass at the company’s annual meeting in Austin, Texas, held yesterday. Despite some criticism, Musk secured support from over 75% of shareholders and is now on track to potentially become the “world’s first trillionaire,” according to Ives.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ives maintains a “Buy” rating on Tesla with a $600 price target, implying 34.6% upside potential. He is a five-star analyst on TipRanks, ranking #323 out of #10,109 analysts tracked. Ives has a 56% success rate and an average return per rating of 16.7%.

Musk’s Package Is a Major Win for Tesla

Ives has solid confidence in Musk’s ability to steer Tesla into a trillion-dollar company, calling him the company’s “biggest asset.” He projects Tesla to reach a $2 trillion market capitalization by early 2026 and $3 trillion by the end of next year, contingent on the successful expansion of its autonomous and robotics roadmap. Shortly after the vote, Ives commented in an X post, “This AI chapter needs one person to lead it and that’s Musk.”

Ives added that with Musk secured as Tesla’s leader for the foreseeable future, the company is set to gain more AI-driven value over the next 6 to 9 months as Full Self-Driving (FSD), autonomous tech, Cybercab, and Optimus expand in the U.S.

Package Is Tied to Performance Milestones

Ives highlighted that shareholders should not be worried about Musk’s massive compensation because it is tied to achieving ambitious operational and financial milestones. These targets include 20 million vehicle deliveries, 10 million active FSD subscriptions, 1 million Optimus robots, and 1 million robotaxis in commercial service.

Moreover, financial goals include achieving $50 billion in adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) and $400 billion in revenue over four straight quarters, while investing heavily in R&D to grow its robotics and AI business. Ultimately, Musk earns his rewards only if Tesla meets its important goals and creates value for shareholders.

Is Tesla a Good Stock to Buy?

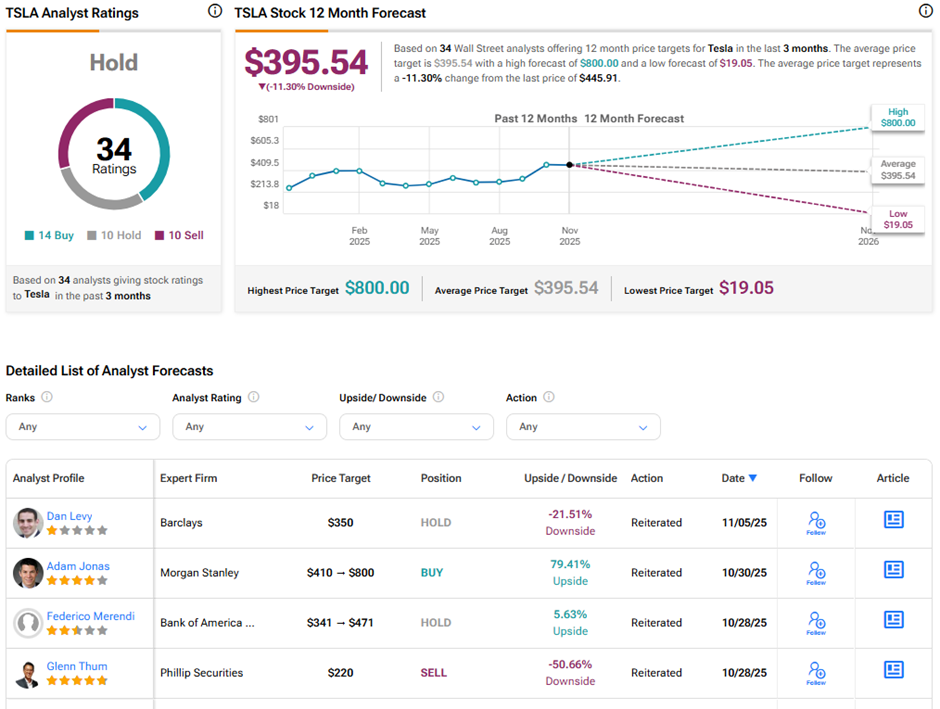

Wall Street prefers to remain on the sidelines regarding Tesla amid declining EV sales and rising competition. On TipRanks, TSLA stock has a Hold consensus rating based on 14 Buys, 10 Holds, and 10 Sell ratings. The average Tesla price target of $395.54 implies 11.3% downside potential from current levels. Year-to-date, TSLA stock has gained 10.4%.