Billionaire investor Elon Musk is being sued by the U.S. Securities and Exchange Commission (SEC) for his unwillingness to abide by subpoenas in the Twitter (now X) takeover case. Musk was asked to testify at the SEC’s San Francisco office on September 15, but he failed to appear. A similar situation occurred when Musk was asked to testify at an office closer to his residential address in Texas. A series of wilful attempts to avoid the subpoenas has forced the SEC to take the legal route.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The SEC is investigating Musk’s Twitter takeover and the reasons for the late disclosure of his substantial stake in the social media platform. Alex Spiro, Musk’s lawyer, replied, stating that the regulator has already taken Musk’s testimony “multiple times.”

Details about the SEC’s Probe

The SEC contends that only two testimonies were conducted in 2022, but subsequently, they have obtained new information and material that they wish to investigate. Musk’s late disclosure of a stake in Twitter had become a moot point in the hearing. Shares of Twitter have behaved erratically since the day Musk announced his intent to take over Twitter.

As per the SEC, Musk has been making “blanket refusals” to appear for testimonies. Some of his reasons include the agency’s intention to “harass him” and that his lawyers needed more time to review the new information. Musk is also avoiding the testimonies as his legal team is reviewing a new biography of Musk written by Walter Isaacson. The team suspects that the book may have “new information potentially relevant to this matter.”

Musk has had a fair share of tiffs with the SEC, and this one comes as no surprise. Musk’s electric vehicle (EV) venture Tesla (NASDAQ:TSLA) is already undergoing scrutiny for misusing the company’s funds to build a glass house for Musk. Moreover, the SEC and Justice Department are probing if Tesla misled investors about the performance of its Autopilot system.

What is the Forecast for Tesla Stock?

Following Tesla’s Q3 deliveries report, JPMorgan analyst Ryan Brinkman raised the price target on TSLA to $135 (48.1% downside potential) from $120 while maintaining a Sell rating. The analyst is not happy about the lower deliveries reported by the EV giant.

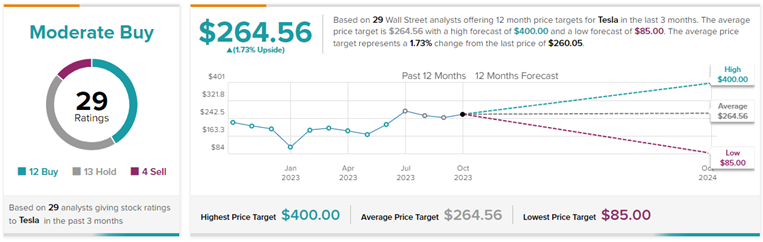

On TipRanks, Tesla stock has a Moderate Buy consensus rating. This is based on 12 Buys, 13 Holds, and four Sell ratings. The average Tesla price target of $264.56 implies 1.7% upside potential from current levels. Meanwhile, TSLA stock has gained 140.6% so far this year.